A Throwback to the Dot-Com Bubble.

The crypto and capital markets are volatile due to economic uncertainty, but the bear market is predicted to be shorter and less severe. Institutional investors are adopting DeFi, and El Salvador plan

Greetings Velvet Fam! Another day, another dolla’ or token — err you know what we mean. 😃

The macro-outlook is still driving capital and crypto markets alike. Last week, the stock market declined due to rising inflation and the expectation of further Fed rate hikes. Crypto markets also retreated a little but still held on to most of the gains of the recent weeks. Despite the strong start to 2023, markets have experienced choppiness in recent weeks. So what’s that mean?

We’re still working through uncertainty. The current economic conditions are similar to those in 2000/2001 (Dot-Com Bubble), with the potential for a short and shallow downturn, aided by healthy labor market conditions. 2023 has left some investors perplexed as they’ve been primed for a recession and stumbling of the economy, however, the economy has proved to be quite resilient. While there are plenty of comparisons being drawn with the Dot-Com Bubble there are also key differences, this bear market is expected to be shorter and less severe, which should encourage investors to stick with their long-term goals.

Investors should be mindful of the current market conditions and adjust their strategies accordingly. Despite the recent fluctuations, the market is still expected to perform well in the long term. As the bear market is expected to be shorter and less severe than in previous periods, investors should have confidence in periodic pullbacks and maintain their portfolio allocations in line with their long-term goals. If you’re bullish long-term, it would be a perfect time to consider dollar cost averaging into a diversified crypto ETF on:

https://velvet.capital/

.

Quick Hitters

· Siemens issued a €60M digital bond on the Polygon blockchain.

· Crypto Capital inflows turn positive for the first time in 9 months:

· Dogecoin and Floki Inu prices soar after Elon Musk shills tokens on Twitter.

· The return of Napster? Napster acquired Web3 music startup Mint Songs.

· Polygon’s development team announced a plan to deliver an Ethereum-compatible rollup powered by zero-knowledge proofs.

· Bitcoin Lightning Network solutions company Strike announced US businesses can now freely utilize its API to integrate Lightning Network for instantaneous transfers.

· Visa announced a partnership with UK-based Wirex, enabling it to offer crypto-enabled debit and prepaid cards.

· The United Arab Emirates is set to launch a central bank digital currency. The country expects this technology to tackle the issue of inefficiency in cross-border payments.

· Lido proposed “Turbo” and “Bunker” modes for post-shanghai Ethereum withdrawals.

In the News

Institutional Investors Eyeing Return to DeFi: Survey

I’m just going to say it — WAGMI! A survey conducted by Avantgarde (Enzyme) of institutional investors said they plan on adopting DeFi as part of their investment strategy. Approximately 75% plan to increase DeFi adoption as CeFi projects continue to go under. 80% of groups surveyed say they are more likely to utilize DeFi following the collapse of FTX, Celsius, and Three Arrows Capital. DeFi evangelists can rest assured that lots of the institutional money that went for CeFi is going to pour into DeFi, not disappear entirely.

Sam Bankman-Fried is Believed to Have Been Using a VPN Since He Was Released on Bail

In other weird yet no longer surprising SBF-related news, he’s in trouble again. He is accused of using a VPN since being released on bail, something the court is not too happy about. SBF’s legal teams stated that he used a VPN to watch the Super Bowl via international streamers. Attorney Danielle Sansoon argues that a VPN could be misused to conduct illicit activities untraceable by the government. A bit ironic how this is only a year removed from CEXs the likes of FTX getting commercial recognition at the previous Superbowl. Let the man watch the Rihanna Halftime Show in peace!

DeFi Staking Players Soar After Kraken Slapped by SEC

Liquid staking protocols like Lido, Rocket Pool, and Frax saw a boon after SEC tightens its grip on Kraken. As part of its settlement, Kraken agreed to shut down its staking operations to comply with an SEC complaint that Kraken did not properly register its staking services before offering them to retail customers. Brian Armstrong, CEO of rival Coinbase, said, “Staking is a really important innovation in crypto [that] allows users to participate directly in running open crypto networks. Staking brings many positive improvements to the space, including scalability, increased security, and reduced carbon footprints.” Investors seem to have more faith in self-custodial staking over centralized staking-as-a-service concepts.

El Salvador to Launch ‘Bitcoin Embassy’ in Texas

The Salvadorian government is planning to open a ‘Bitcoin Embassy’ in Texas. The country’s Ambassador to the US announced a meeting with her US counterpart in Texas about the feasibility of this idea. The particulars are not clear but probably would act like a liaison office to promote US investment into El Salvador’s growing Bitcoin sector. Issues with fiat currencies in certain Latin American countries have brought a lot of legitimacy and interest in cryptocurrencies like Bitcoin as a practical hedge against inflation.

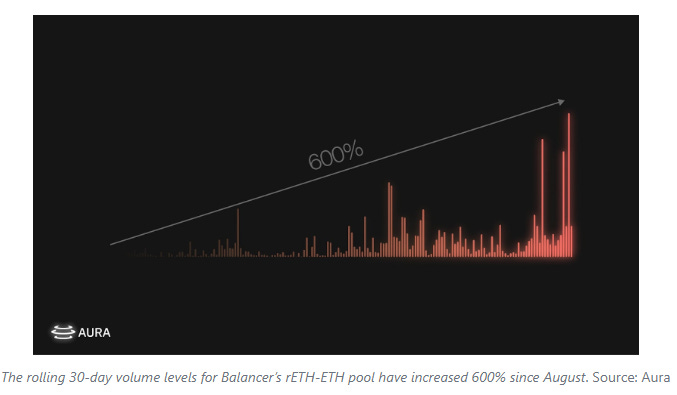

Balancer Shakes Off Rivals’ Shadow with Novel Strategy

Particularly in the world of business, sometimes boring is best. Such is the case with Balancer, which has shown relative stability compared to rivals Uniswap, Curve, and SushiSwap. While Balancer’s TVL remains solid on Ethereum ($1.1B), the number of assets on Polygon jumped around 55% year-to-date. Part of this success is attributed to Aura Finance, a yield-generating integration, which grew 23% this past month to $540M in TVL. 0xSami, the pseudonymous founder of Redacted said, “Right now I think it’s LSD season and they really positioned themselves well to be at the forefront of it.” Read the full article for a great overview of what makes a successful DEX.

Want to know what Whales in Crypto are buying?

Refer 3 friends and get a free, exclusive report on the top Crypto holdings of top Hedge Funds and Whales!

Create Custom DeFi Portfolios Easier Than Ever Before

Don’t forget to take a look at what the future of DeFi has to offer: Velvet.Capital.

You can get exposure to all the best projects in just a few clicks. Not bad right? Position yourself to take advantage of the next bull run market today! Create a portfolio here: https://velvet.capital/