Another CeFi Goes Bust & The Twitter War of 2023

Genesis files Chapter 11 Bankruptcy, Winklevoss Twins versus Silbert, FTX, and GBTC's Discount

GM

Lets sing on repeat - “Another CeFi Bites The Dust”

Here’s what we’ll cover today:

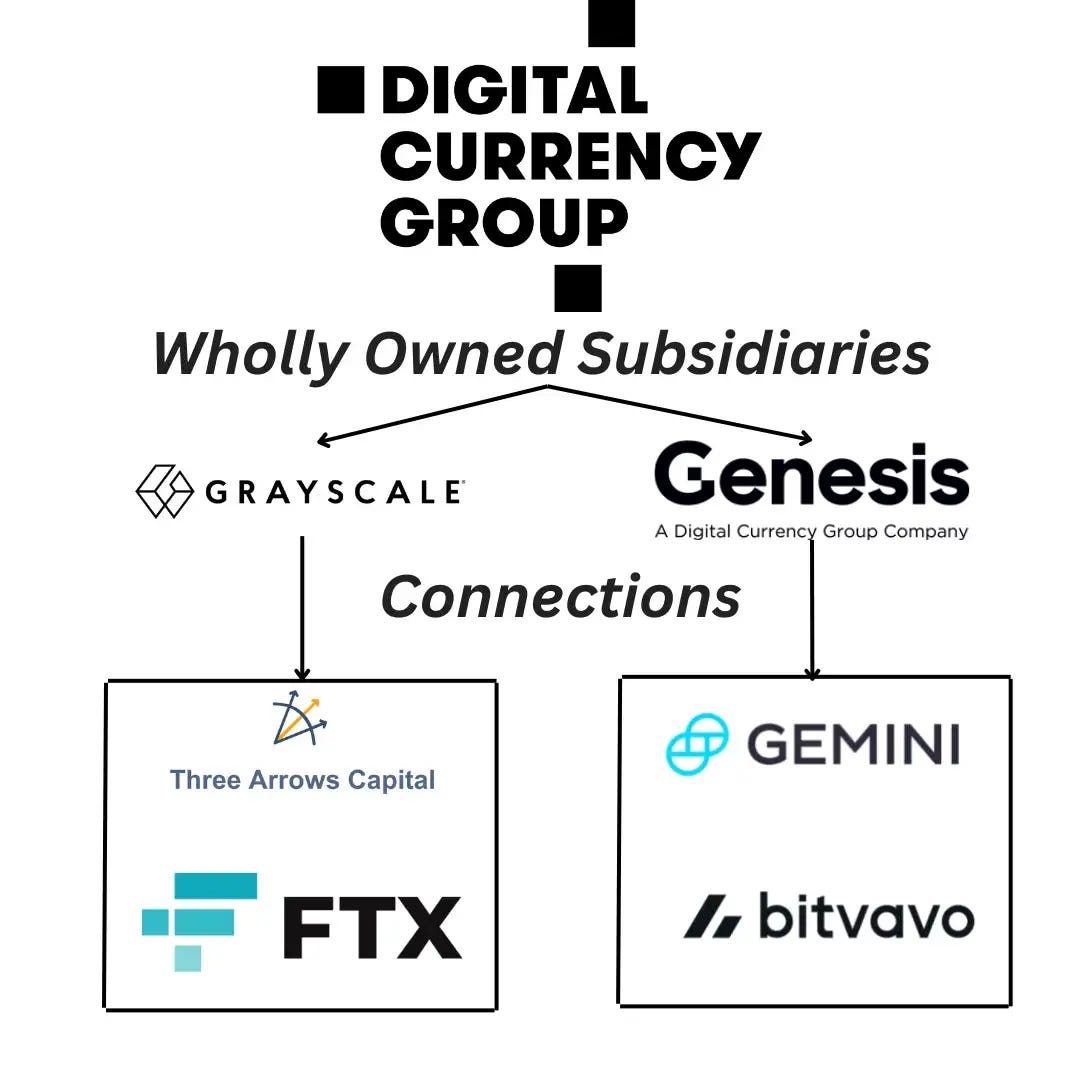

Who is DCG, Genesis, and Grayscale

Why GBTC is at a High Discount

SBF Contagion

Winklevoss Twins vs. Barry Silbert

Genesis Chapter 11

Why Are Market’s Up Unlike FTX, Celcius, 3AC, and Others

To read the full article visit: Understanding the DCG, Genesis, and Grayscale Saga

Who Is DCG, Genesis, and Grayscale

DCG (Digital Currency Group): US cryptocurrency venture capital and holding company founded in 2015 by Barry Silbert. They’re one of the largest investors in the cryptocurrency space with investments in Coinbase, Circle, Silvergate, Ripple, Lightning Network, and many more. Also has Grayscale, Genesis, and CoinDesk as wholly-owned subsidiaries. At peak AUM of DCG was $50 Billion.

Genesis: Centralized Cryptocurrency Prime Broker (provides services to institutions) and offers Custody of Assets, OTC Trading, and Extending Credit.

Grayscale: digital currency asset management company founded in 2013 by Barry Silbert. They are most known for the Grayscale Bitcoin Trust (GBTC) which was also launched in 2013 and has $10B in AUM. For many years, the only way institutions were able to invest in bitcoin, in a compliant manner to the SEC, was through buying shares of GBTC.

Why GBTC is at a High Discount

The trust started to collapse when Terra Luna fell apart in May of 2022.

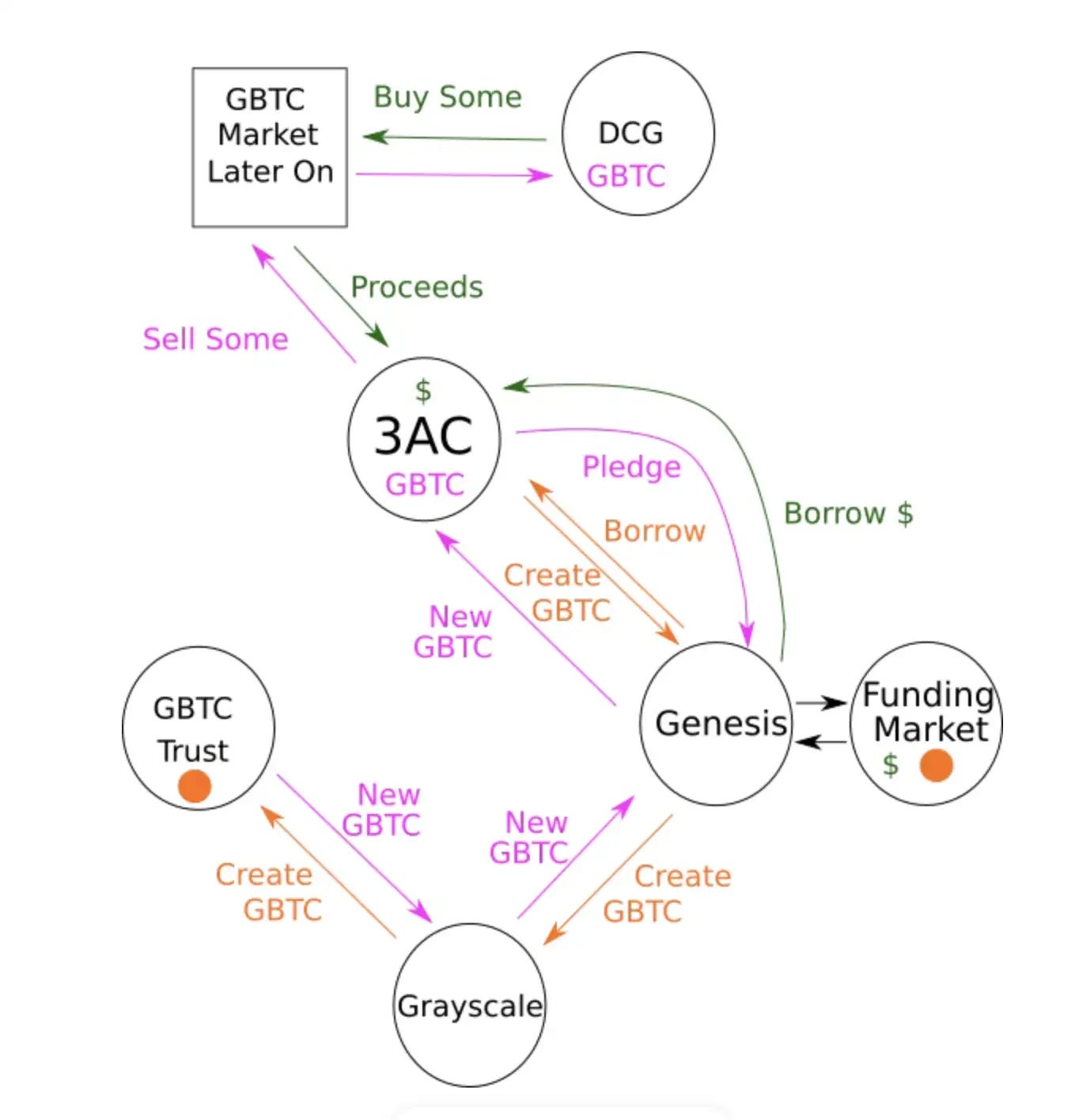

That’s because 3 Arrows Capital (3AC) and DCG (along with Grayscale and Genesis) to create a scheme where they would borrow USD from Genesis with GBTC as collateral.

Here’s a diagram of the scheme used:

Then 3AC lost billions in the Terra Luna crash, so they were unable to pay back their loans from Genesis.

Since 3AC had declared bankruptcy and the fact they owned so much of the trust cause many who could to sell their shares. And created a discount.

The worry with GBTC now is that investors and creditors in Genesis could go after DCG and Grayscale (majority owner and controller of the trust) in the bankruptcy case.

SBF Contagion

Genesis also suffered losses from the FTX collapse in November.

And after a series of tweets where Genesis kept changing the amount they lost, the final one said they had $175 Million of exposure in a trading account.

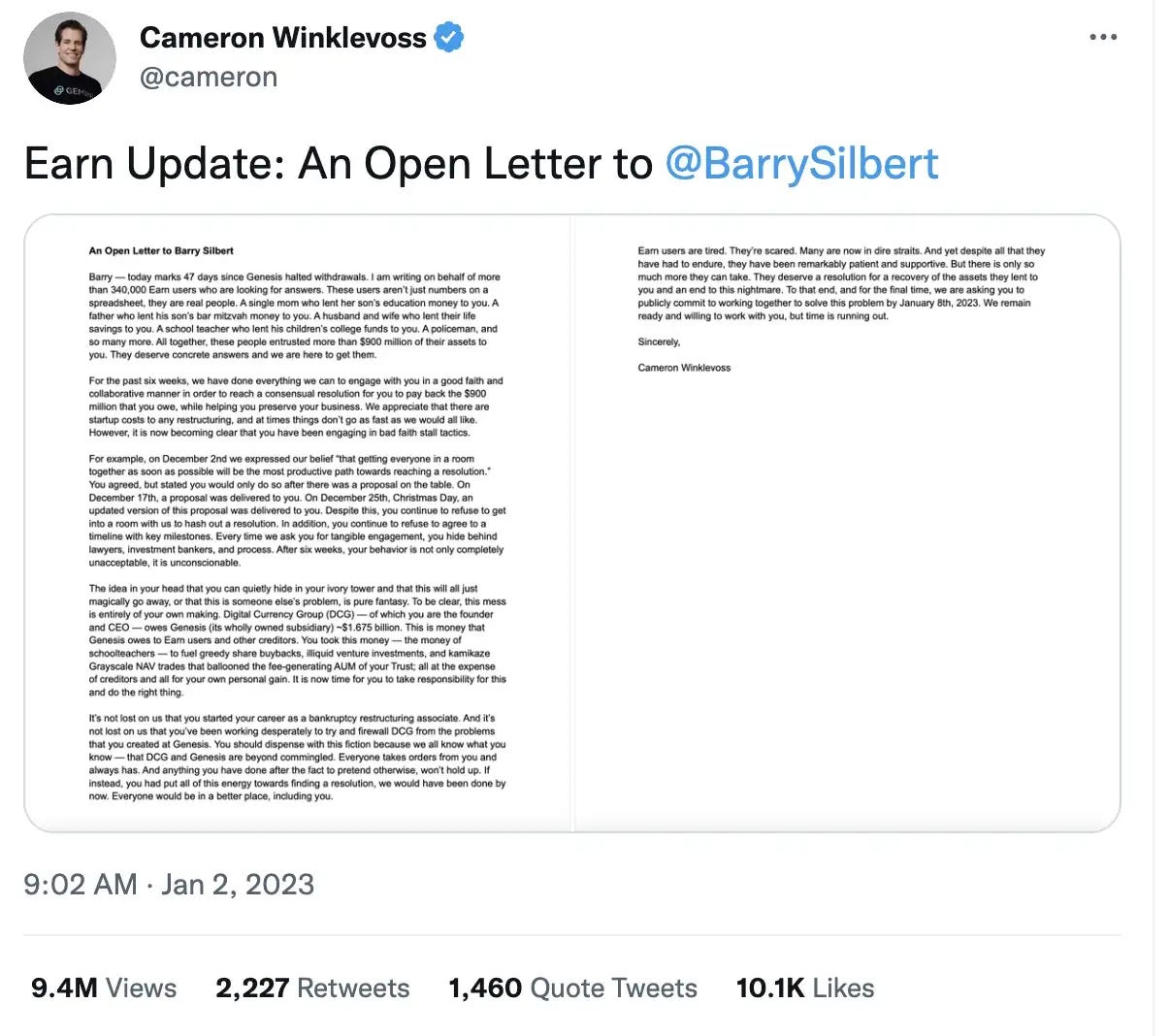

Winklevoss Twins vs. Barry Silbert

In one of the most public disputes between CEO’s, Cameron Winklevoss is determined in going after Barry Silbert on Twitter for not repaying the $900 Million Genesis owes Gemini Earn customers.

Gemini Earn: A centralized lending service where users opted into letting Gemini lend out their crypto holdings for interest payments.

Cameron Winklevoss has posted multiple letters like this one calling for Genesis to sit down and come to a resolution with Gemini, Barry Silbert to be fired, and calling out the Promissory Note DCG gave Genesis.

DCG Promissory Note: DCG gave Genesis a $1.1 Billion promissory note in the summer of 2022 to recover from the losses of 3AC and others.

The problem with the promissory note is it did not give the cash to pay off everyone they owed money to right away, but was able to cover up how big the balance sheet hole was.

Winklevoss claims that the Genesis bankruptcy will be good for Gemini Earn customers getting their money back.

Genesis Chapter 11 - What This Means

After denying the rumors, Genesis filed for Chapter 11 Bankruptcy on Friday morning.

Which is a rapidly growing situation and is going to have a significant impact on the market.

However, at the point of writing, the Cryptocurrency market is up.

Bitcoin up 8.47%

Ethereum up 5.62%

Why is this?

This could be for a few reasons:

1 - Market Prices

Market Prices in their natural state are a reflection of all past, present, and future knowledge of an asset. In the case of FTX, Voyager, Celcius, 3AC, Terra Luna, and others we did not see the bankruptcy coming for very long.

In the case of Genesis, people had been discussing the possibility since FTX declared bankruptcy 2 months ago.

2 - Liquidity

We may also not be experience as much of a drop because a good proportion of the investors who would be selling at this point, can’t.

They have their funds locked in Celcius, Voyager, Blockfi, FTX, and Gemini.

The people who are still around are more and more users of cold storage. These people tend to be long-term holders and therefore when bad news hits, they don’t rush to sell.

Want Exclusive Rewards from Velvet.Capital?

Refer 3 friends and get access to our exclusive DeFi Newsletter.

How Does Velvet.Capital Help You Achieve Crypto Investment Success?

Crypto investing can be hard. DeFi can be even harder. But it doesn’t have to be! At Velvet.Capital, we believe in DeFi done right. We’re passionate about the transformational nature of DeFi and want to help onboard the next billion users into crypto.

We help people create diversified crypto products with additional yield — all without giving up custody of their assets! No matter your level of expertise — we got you covered!

Are you in?

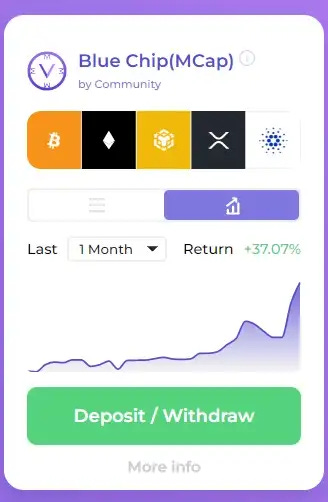

This portfolio has a 37% gain in one month.

This is an example of one of the portfolios available on Velvet.Capital — our Blue Chip portfolio that is made up of the top 5 cryptocurrencies by total market capitalization excluding stablecoins, weighted by market cap, and rebalanced every 2 weeks.

Until next time,

Cheers!