Are Interest Rates Peaking?; Coinbase rolls out Perp Futures; And Bitboy Bites the Dust!

This weeks Weekly DeFi Roundup: Whats happening in both the Crypto and Macro Market?

Market Landscape

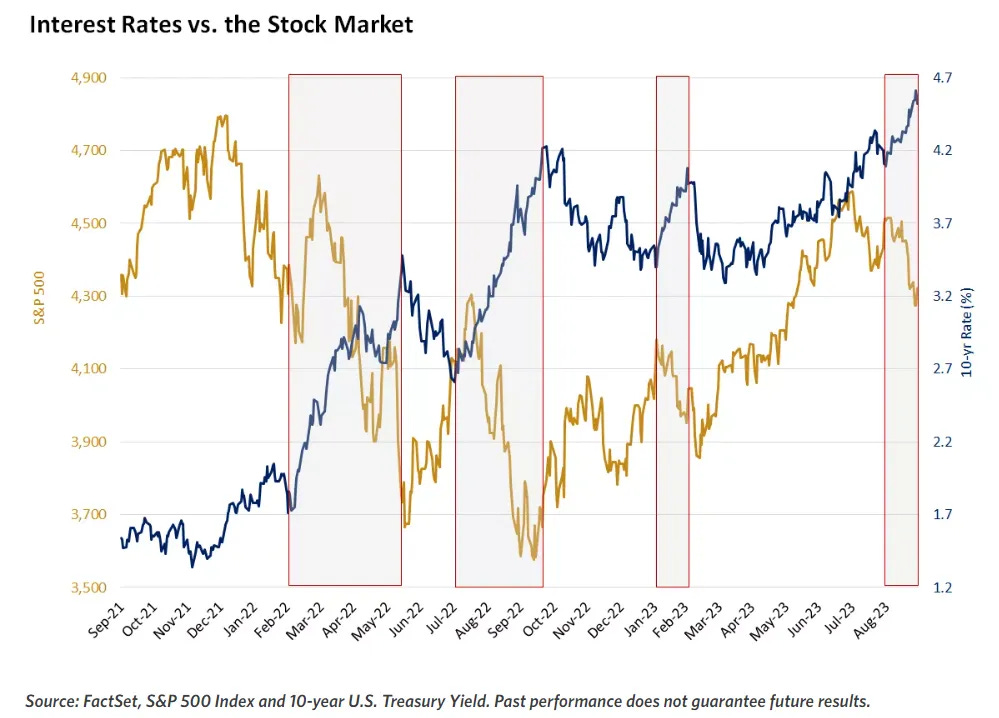

Time to call the (rate) top? Continued rate hikes, driven by new expectations on Fed policy, have put downward pressure on equity markets. One encouraging trend we mentioned before has continued as the crypto markets remain not only resilient to this selling pressure but have made modest gains. This can certainly be viewed as a bullish divergence from the broader market.

The Fed’s indication of a longer-lasting restrictive monetary policy has led to concerns among investors. While the prospect of higher interest rates has negatively impacted stocks, some analysts believe that the Fed’s tightening may not require significant additional rate hikes. They argue that it’s time rather than further rate increases that’s needed to curb inflation, suggesting that the recent market reaction may present an opportunity.

Despite the unease caused by the 10-year Treasury yield rising above 4.6%, its highest since 2007, historical data shows that previous peaks in interest rates have often acted as catalysts for stock market rallies (don’t forget Mr. Market is at least 6 months ahead!). Notably, the current inflation environment is more favorable than during previous rate spikes, with inflation showing signs of moderating. Suppose this trend continues and economic momentum softens as expected. In that case, rates may be nearing their peak for this cycle, potentially setting the stage for a stock market rebound by the end of the year. Good news for all the HODL’ers out there — any sort of peak signal on rates and accompanying rally in equity markets would most likely act as a strong tailwind for the crypto markets. Let us know what you think below!

Quick Hitting Alpha

· VanEck, a leading global asset manager, has announced its intention to allocate 10% of the proceeds from its upcoming Ether ETF to support Ethereum developers through the Protocol Guild, a group of 152 core protocol contributors, for a minimum of 10 years, illustrating the company’s strong commitment to the Ethereum community and encouraging other traditional financial institutions to do the same.

· Aave is gearing up for a governance overhaul, utilizing Polygon and Avalanche for cost-effective voting, covered by the Aave DAO, after discussions about the upgrade began in January 2022, and now, following governance approval in July, the Aave community is working to finalize the upgrade roadmap.

· The Bitcoin Ordinals community is discussing indexing the protocol and addressing concerns that Casey Rodarmor’s proposal to fix cursed Ordinals may affect early collectors while exploring solutions like Danny Yang’s idea of preserving order with snapshots.

· Ripple, known for its XRP token, has called off its acquisition of Fortress Trust but intends to remain an investor and collaborate with the company in the future, according to Ripple CEO Brad Garlinghouse.

· Su Zhu, co-founder of the bankrupt crypto hedge fund Three Arrows Capital (3AC), has been arrested at a Singapore airport as he tried to leave the country, with the news first revealed by Teneo, the firm handling 3AC’s liquidation.

· Ledn, a centralized crypto lender, now provides ETH staking with instant transactions and up to 2% APY but faces competition from the thriving liquid staking token sector as CeFi players seek streamlined onboarding.

· Kraken, the U.S.-based crypto exchange, is reportedly planning to offer trading for US listed stocks and ETFs in the U.S. and UK, marking its first venture outside the cryptocurrency industry, as per a Bloomberg report citing an inside source.

· Gary Gensler, SEC chair, reiterated in his recent congressional testimony that Bitcoin (BTC) is not considered a security and is not subject to securities laws.

· Curve Finance founder Michael Erogov has paid off his debts on Aave v2 but still owes $42.7 million in stablecoins to four other web3 lending platforms, backed by $132.5 million in CRV collateral, following his lending activities amid a crypto market downturn and private sales of his CRV collateral initiated in August to mitigate the risk of liquidation and potential bad debt for Aave due to a 40% price drop.

In the News

Coinbase rolling out perpetual futures trading for retail users outside the US

Coinbase has received the green light from the Bermuda Monetary Authority (BMA) to introduce perpetual futures trading for retail customers outside the US, following its impressive performance in handling over $5.5 billion in institutional futures trading volume. Coinbase’s global expansion focuses on 24 countries, including G20 members and key regions such as Hong Kong, Switzerland, the UAE, and Singapore. Despite ongoing regulatory challenges in the US, Coinbase remains committed to improving the global financial system and expanding economic opportunities worldwide. This move aligns with Coinbase’s “Go Broad, Go Deep” strategy, with plans to advocate for international regulatory standards at the upcoming G20 summit in Brazil.

Ben ‘Bitboy’ Armstrong Arrested After Livestream Rant (RIP)

Crypto influencer Ben Armstrong, once the face of Bitboy Crypto, was arrested during a livestream outside his former partner’s house where he believed his missing Lamborghini was located. This incident followed Armstrong’s exit from the HIT Network, owners of Bitboy Crypto, and his unsuccessful attempt to regain control of the brand. During his livestream from crypto investor Carlos Diaz’s residence, Armstrong made allegations of threats, mafia connections, and Lamborghini theft. His arrest on charges of loitering/prowling and simple assault ensued, with Diaz later confirming Armstrong’s presence via security footage. The crypto verse is buzzing with questions about the circumstances surrounding Armstrong’s arrest and the ongoing feud with his former network.

¡Hola Argentina! Buenos Aires Brings Digital Identity to Millions of Citizens

Buenos Aires is pioneering a digital identity initiative, leveraging blockchain technology to provide its residents with self-sovereign control over personal data and documents. Powered by QuarkID and secured by zkSync Era, this innovative system enables citizens to manage vital records, health data, and future payments. Starting in October, residents can download the QuarkID wallet for document access, with additional services like academic verification and income proof slated for November. This initiative, initially serving over 15 million residents, has the potential to scale across Argentina’s 45 million population and serve as a model for Web3 identity adoption in government, emphasizing data ownership and privacy.

New US bill to require firms to report off-chain transactions to CFTC

A new US bill, the “Off-Chain Digital Commodity Transaction Reporting Act” introduced by Representative Don Beyer, seeks to require cryptocurrency service providers to report all blockchain transactions to a government repository registered with the Commodity Futures Trading Commission (CFTC). The bill aims to enhance transparency and investor protection by addressing disputes, fraud, and manipulation in off-chain transactions and those beyond the blockchain. Off-chain transactions, often favored for their speed and cost-efficiency, must be reported within 24 hours to a CFTC-registered trade repository, aligning the cryptocurrency market with regulations akin to those for securities and swaps transactions.

Exploring Umoja, the NFTs that Transform Lives in Uganda

Umoja NFTs, meaning “unity,” blend Web3 technology with philanthropy, supporting orphans in Uganda through the sale of digital art. The project is distinct as the orphans create these unique digital pieces, with proceeds securing their future through land purchases for Dasom Ministries Orphanage. Umoja symbolizes the fusion of art and compassion, with a broader vision to extend its impact throughout Africa. Whether you purchase an NFT or donate directly, you play a part in real-world transformation.

Professional-Grade DeFi For Everyone

Crypto can be hard. DeFi can be even harder! But it doesn’t have to be!

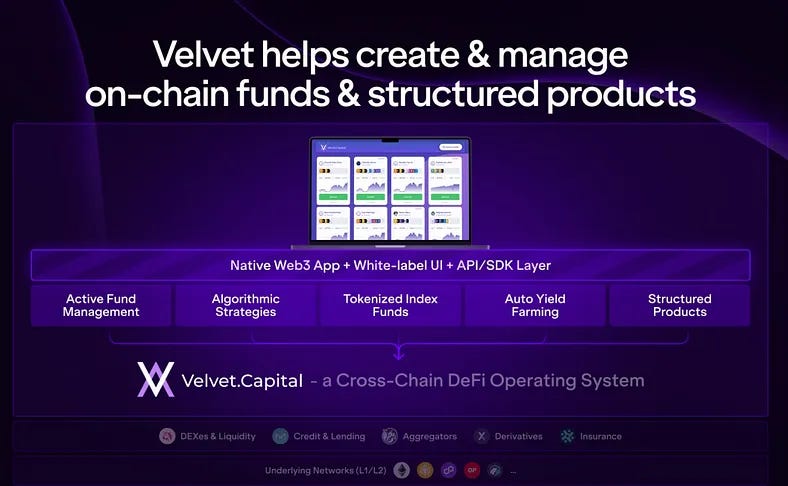

At Velvet Capital, we are building the world’s first institutional-grade, omnichain DeFi asset management operating system! Anyone will be able to seamlessly launch and manage on-chain funds — in just a few clicks. Crypto portfolio management like never before!

We help people create diversified crypto products with additional yield — all without giving up custody of their assets! No matter your level of expertise — we got you covered!

Join Velvet DAO Today!

Join the Velvet Family! Top web3 builders, giga-brains, fund managers, & investors await you in Velvet DAO!

Follow us on Twitter, LinkedIn and join us on Discord & Telegram for more updates! We want to hear from you, don’t be shy.

Refer 3 friends and win a NFT from Velvet Capital!