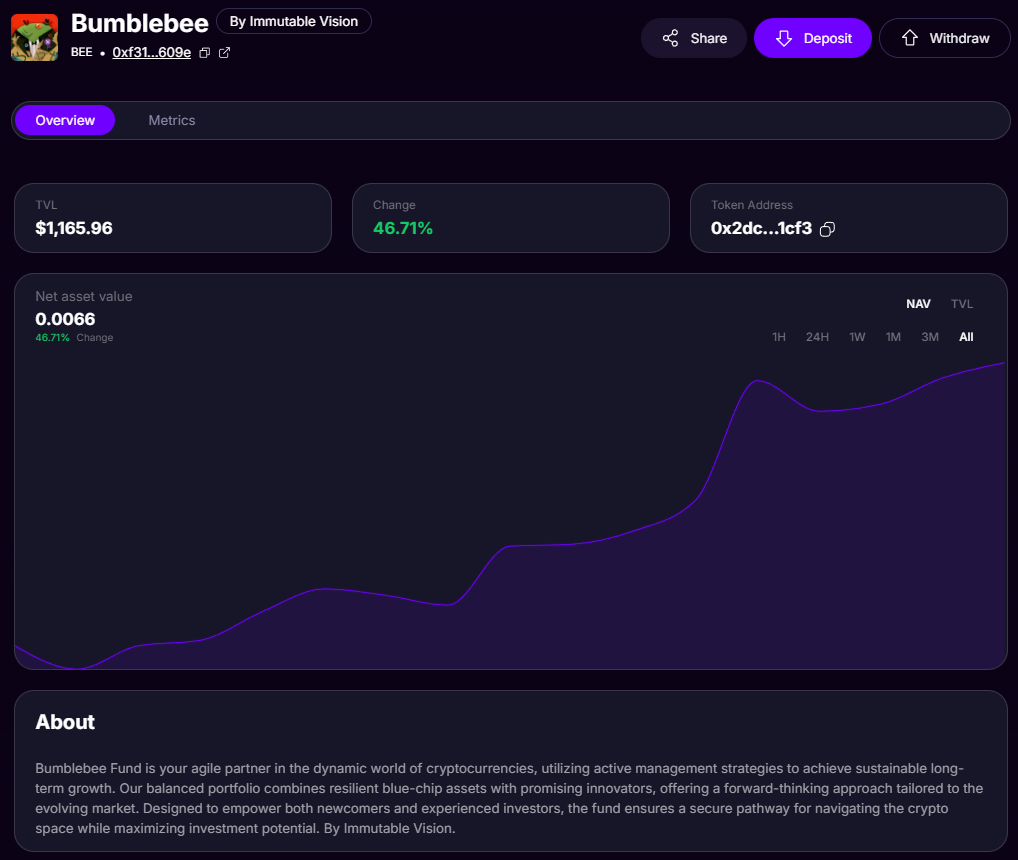

Bumblebee Fund by Immutable Vision on Velvet Capital

Bumblebee Fund on Base: hold blue chip assets like BTC and ETH for strong gains along with a basket of utility altcoins that could be disruptors in key sectors

With Velvet Capital, anyone can launch and manage their portfolios on Base, Ethereum, or BNB Chain and use our intent-based trade execution to get best-in-class trade routing for every trade onchain… even in and out of DeFi Protocols!

Today we are announcing the Bumblebee Fund on Base that aims to hold blue chip assets like BTC and ETH for strong gains this cycle along with a basket of utility altcoins that could be disruptors in key sectors and go for high returns.

The Strategy

The Bumblebee Fund strategy focuses on a diversified portfolio built around Wrapped Ethereum (WETH), Coinbase Bitcoin (CBTC), and high-potential utility tokens like $ZRO, STG 0.00%↑ , $AXL, and $LMWR. In this strategy WETH and CBTC serve as hedges, providing stability and market exposure, while the utility tokens are selected for their innovative use cases and potential to disrupt key sectors.

$ZRO and $AXL are in the fund because they are revolutionizing cross-chain liquidity, enabling seamless interoperability and driving DeFi adoption. $STG enhances multi-chain connectivity and efficiency, while $LMWR leverages a robust community and strong utility to expand blockchain adoption through DePIN and AI. These tokens’ proven value and performance make them prime candidates for substantial growth in 2025.

This portfolio is actively managed (meaning the portfolio manager can make decisions about the tokens in it) and is rebalanced regularly to ensure gains are locked in during rallies. Profits from outperforming tokens, such as $ZRO or $STG, are redistributed into WETH, CBTC, or undervalued opportunities in the market. Similarly, if WETH or CBTC outperforms utility altcoins, the profits are rotated into tokens showing potential. This strategy maximizes returns, minimizes risk, and positions holders of the portfolio for sustained growth as the bull market evolves.

You can think of it like a barbell strategy: WETH and CBTC anchor the portfolio, providing stability and broad market exposure while $ZRO, $STG, $AXL, $LMWR, and maybe others that arise are more high risk high return plays and get allocation due to their strong use cases, community, and sector innovation.

Through active rebalancing profits are locked in and reinvested in undervalued opportunities.

This portfolio has lots of growth potential, positioning itself for sustained performance and growth into 2025 as innovative tokens expand adoption.

The Bumblebee Fund also has no fees and therefore holders are able to hold, profit, deposit, and withdraw without having to pay the portfolio manager.

Since creation on November 19th, this portfolio has gained 46%!

Check out the Bumblebee Fund