Crypto Development After A Long 2022

After a long 2022, Crypto Development is slightly down. However, it's not all negative when it comes to BTC and other blue chip projects Development.

GM

When considering the inclusion of web3 projects in your crypto portfolio, it is important to consider a number of factors before making any investment.

One of the most critical aspects to examine is the state of a particular blockchain.

Sometimes people say follow the money but in this case, it might be more prudent to follow the developers.

Every year the annual 2022 Developer Report by our friends at Electric Capital provides a comprehensive overview of the development status of Ethereum, Bitcoin, and other prominent blockchains.

To read the full 200 page report click here

To save you some time, the team at Velvet.Capital summarized some of the most critical information.

Here’s what we will cover:

State of Development

Number of Developers Relative to Price

Who’s Leaving

Bitcoin, Ethereum, and Binance Development

DeFi Development

To read the full article visit: 2022 Developer Report Analysis

State of Development

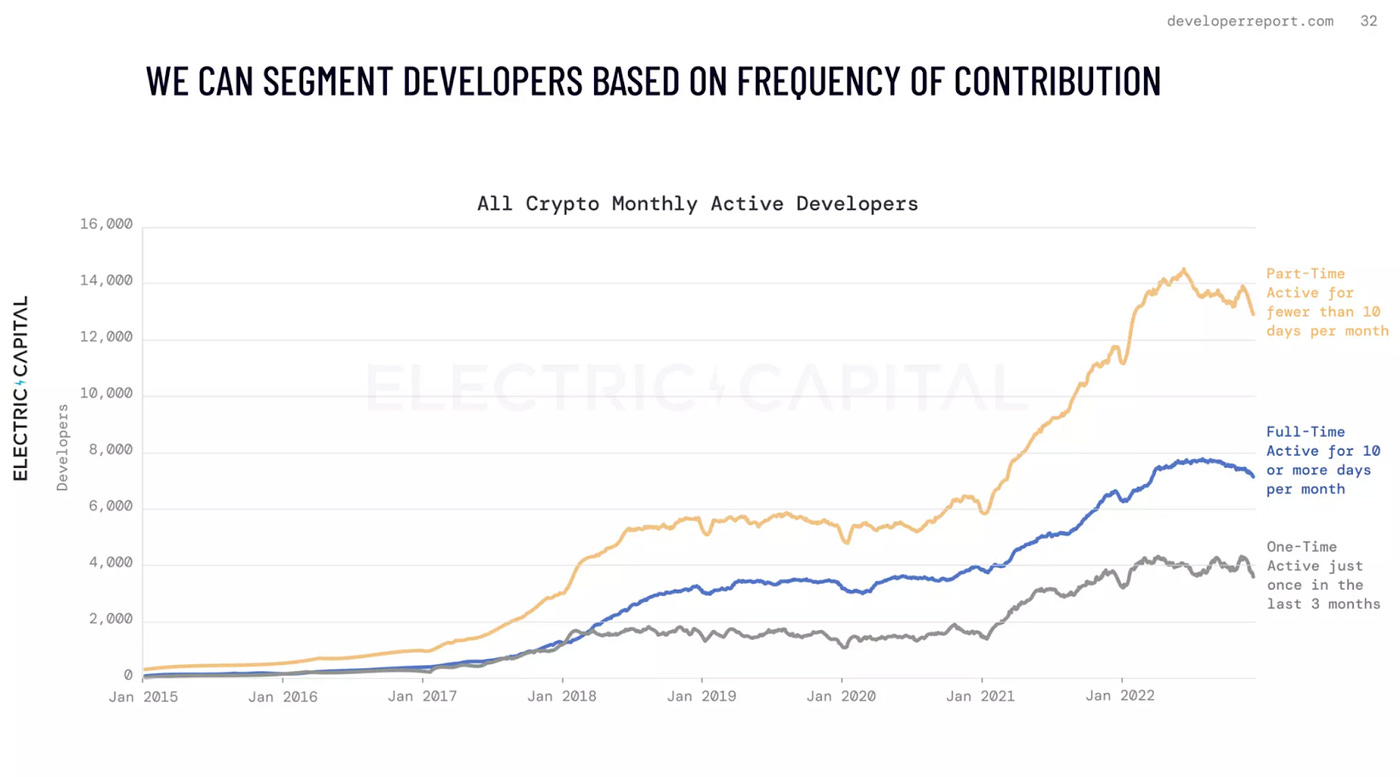

Most of the developer growth in crypto occurred during the last two bull runs — essentially since the emergence of projects like Ethereum, Polygon, BNB, and others who have entered the market and developed DeFi, NFTs, Metaverse, and other utilities on the Blockchain.

The largest segment of is part-time developers. The second-highest is full-time developers. The lowest is one-time.

Number of Developers Relative to Price

Where do you think the peak in the number of Developers is compared to the peak in price during a cycle?

The peak in monthly active developers during the cycle actually typically happens near the bottom of the bear market.

In 2017, the peak in developer count was very close to the bottom. For this current cycle, it looks like it may have been close to the bottom (unless we see a lower bottom in this cycle).

Who’s Leaving

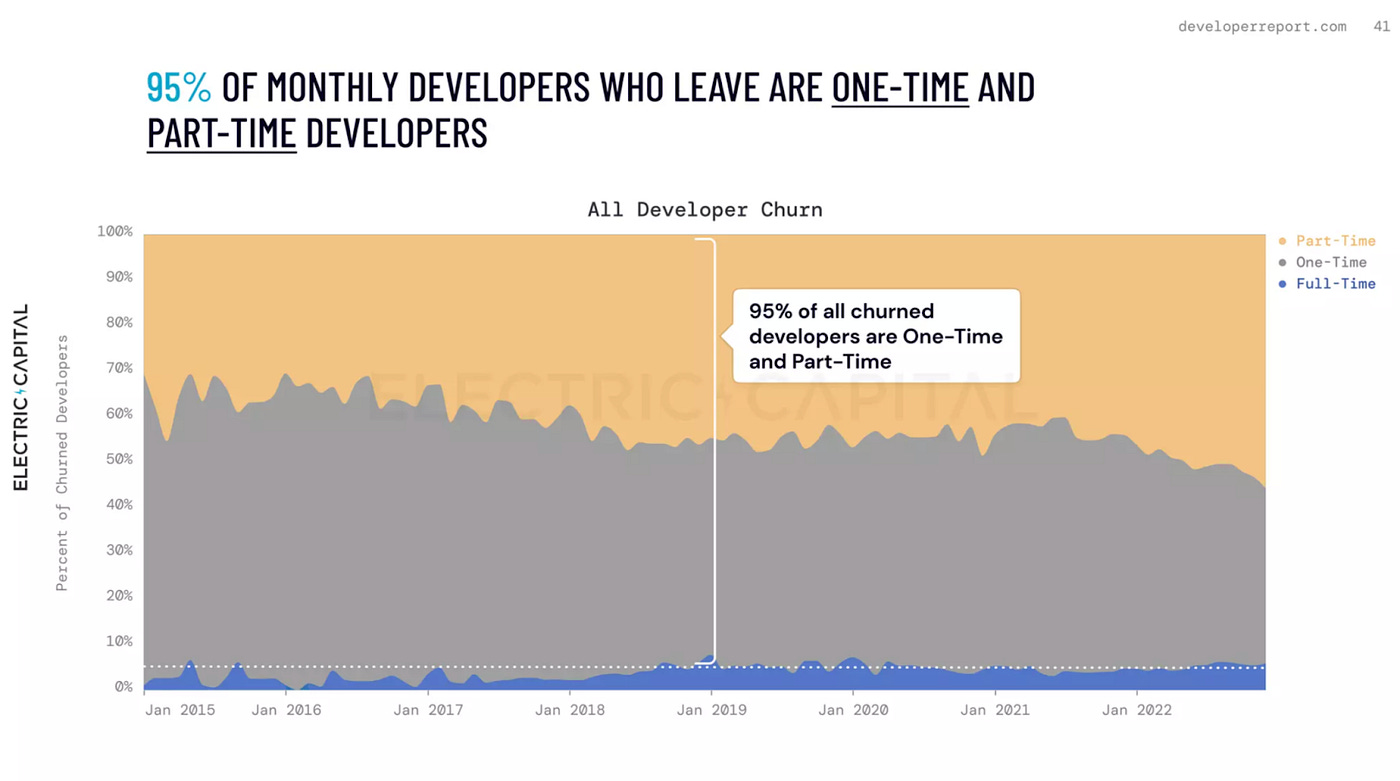

Most developers that come and go with market prices are one-time and part-time developers.

Full-time developers are much more likely to continue building during the depths of the bear market, as only 5% of the churn is full-time developers.

Of the people still in crypto and coming into the ecosystem, where are they working?

28% of developers work for bitcoin or Ethereum, and 50% of developers work on one of the other top 200 projects.

Bitcoin, Ethereum, and Binance Development

Bitcoin currently has around 920 active developers (as of December 2022), down slightly over the past year from 944 in December 2021.

Over the past year, Ethereum has actually gained developers slightly (+5%).

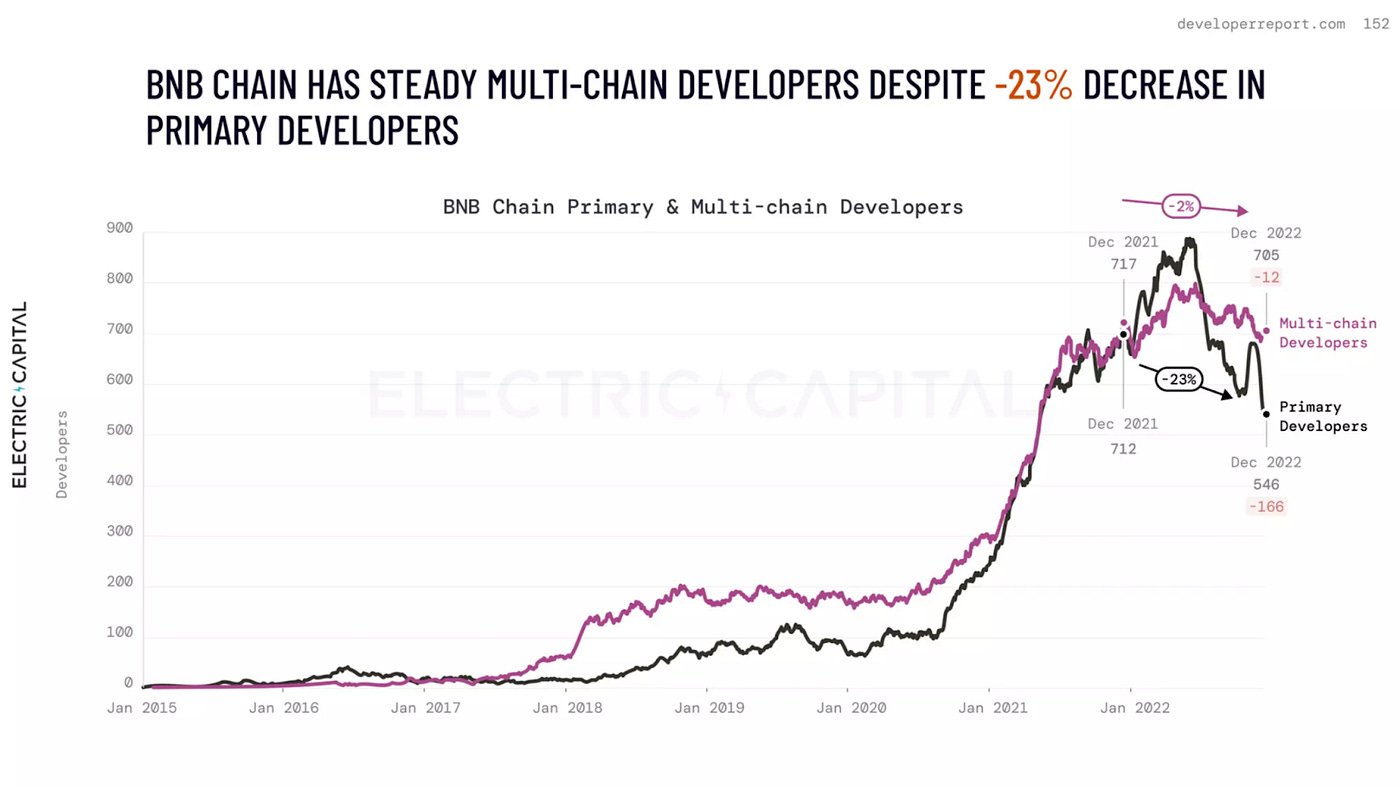

Binance (BNB Chain) lost 23% of the primary developers and 2% of their multi-chain Developers.

DeFi Development

The real growth in DeFi development started during the DeFi Summer of 2020 with the number of developers growing from 1,100 in 2020 to about 4,700 at its peak in early 2022.

It’s important to note that the smallest segment that accounted for the highest loss in developers was one-time developers.

Most of the development in DeFi is still happening on Ethereum.

However, since DeFi Summer the percent of DeFi Developers on Ethereum has dropped 20%.

How Velvet.Capital Positions You For Investing Success

Crypto investing can be hard. DeFi can be even harder. But it doesn’t have to be! At Velvet.Capital, we believe in DeFi done right. We’re passionate about the transformational nature of DeFi and want to help onboard the next billion users into crypto.

We help people create diversified crypto products with additional yield — all without giving up custody of their assets! No matter your level of expertise — we got you covered! You can get exposure to all the best projects in just a few clicks.

Not bad right?

Here’s an example of one of the portfolios available on Velvet.Capital — our Yield By Venus portfolio is made up of 10 cryptocurrencies that earn extra yield through Venus Protocol. This portfolio gets rebalanced every 2 weeks so you don’t become overexposed to any one asset. This portfolio has a 30% gain in one month.