Earn APY on Stables with Overnight Finance on the Velvet Capital Base App

Earn 15%+ on USD through Overnight Finance's Delta Neutral Strategies on Velvet Capital!

Over the past year, crypto-native yield strategies for stablecoins have seen explosive growth. As funding rate arbitrage and other delta-neutral strategies gain traction, they’re offering an attractive alternative for earning consistent, high returns without exposing users to market volatility. Stablecoin yields are no longer just about parking assets and a few percent from lending - but the underlying funding rates.

Overnight Finance is at the forefront of this transformation, and now, through a strategic partnership with Velvet Capital, we are bringing USD+ to our platform. USD+ is a yield-generating stablecoin that makes it easier than ever to earn predictable returns on stable assets. With this listing on Velvet Capital users can seamlessly integrate high-yield stablecoin strategies into their portfolios or trade natively in your wallet through the trade terminal.

Overnight Finance: Redefining Stability and Yield in DeFi

Overnight Finance is a leading DeFi platform, with most of its TVL on Base, specializing in stablecoins and delta-neutral strategies. At the core of its offerings is USD+, a fully collateralized, yield-generating stablecoin pegged 1:1 to USDC. Designed for users seeking passive income without price volatility, USD+ delivers reliable daily profits from carefully selected DeFi strategies.

What sets Overnight Finance apart is its focus on ensuring both transparency and stability. Every USD+ is backed by USDC, and the team actively monitors risk exposure to protect user assets, making it a go-to choice for DeFi participants seeking consistent returns.

How USD+ Works

USD+ combines the stability of traditional stablecoins with the earning potential of DeFi. Here's how it operates:

Collateralized by USDC: Each USD+ is minted 1:1 against USDC, ensuring full collateralization.

Daily Yield Accrual: USD+ holders earn profits daily, which are automatically compounded back into their holdings through a rebase mechanism

Delta-Neutral Strategies: Profits come from deploying USDC into delta-neutral DeFi strategies, such as funding rate arbitrage, lending, staking, and liquidity pools. These strategies are carefully selected to maintain stability while maximizing returns.

Redeemable Anytime: Users can redeem USD+ for USDC at any time

What Happens If Funding Rates Go Negative?

USD+ is designed to provide stable and predictable yields, but funding rates in DeFi markets can occasionally turn negative. In such cases, Overnight Finance dynamically adjusts its strategy to minimize exposure to unfavorable conditions. This might involve reallocating capital to alternative delta-neutral strategies to ensure that yields remain positive and user capital stays protected. By proactively managing these scenarios, Overnight Finance ensures that USD+ continues to be a reliable and secure asset for users seeking yield on stables.

Trading USD+ on Velvet Capital

USD+ by Overnight Finance is tradeable in the Trade Terminal and you can add it to your portfolio as well. To add USD+ to your portfolio on Base, follow these steps:

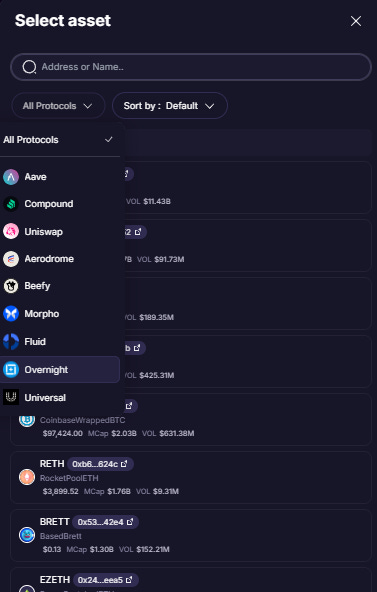

Select Overnight in Protocols tab

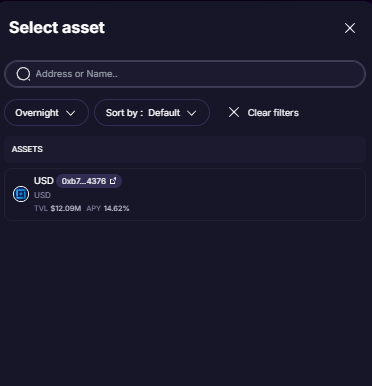

Add USD+ to your portfolio by selecting

Trade