How to Keep Your Digital Assets Safe: Velvet.Capital's Guide to Digital Asset Custody

Discover digital asset custody essentials, comparing non-custodial, third-party custodial, self-custody, and MPC wallets for secure crypto control.

GM

Yesterday we dropped a blog post detailing the different ways to hold custody of your digital assets, this is the shorter version.

If you’d like to read the full guide check out This Blog Post

Here’s what we’ll cover:

Why Self Custody is Important

Types of Digital Asset Custody: Non-Custodial, Third Party, Self Custody via Multisig, MPC Wallets

Velvet Vaults

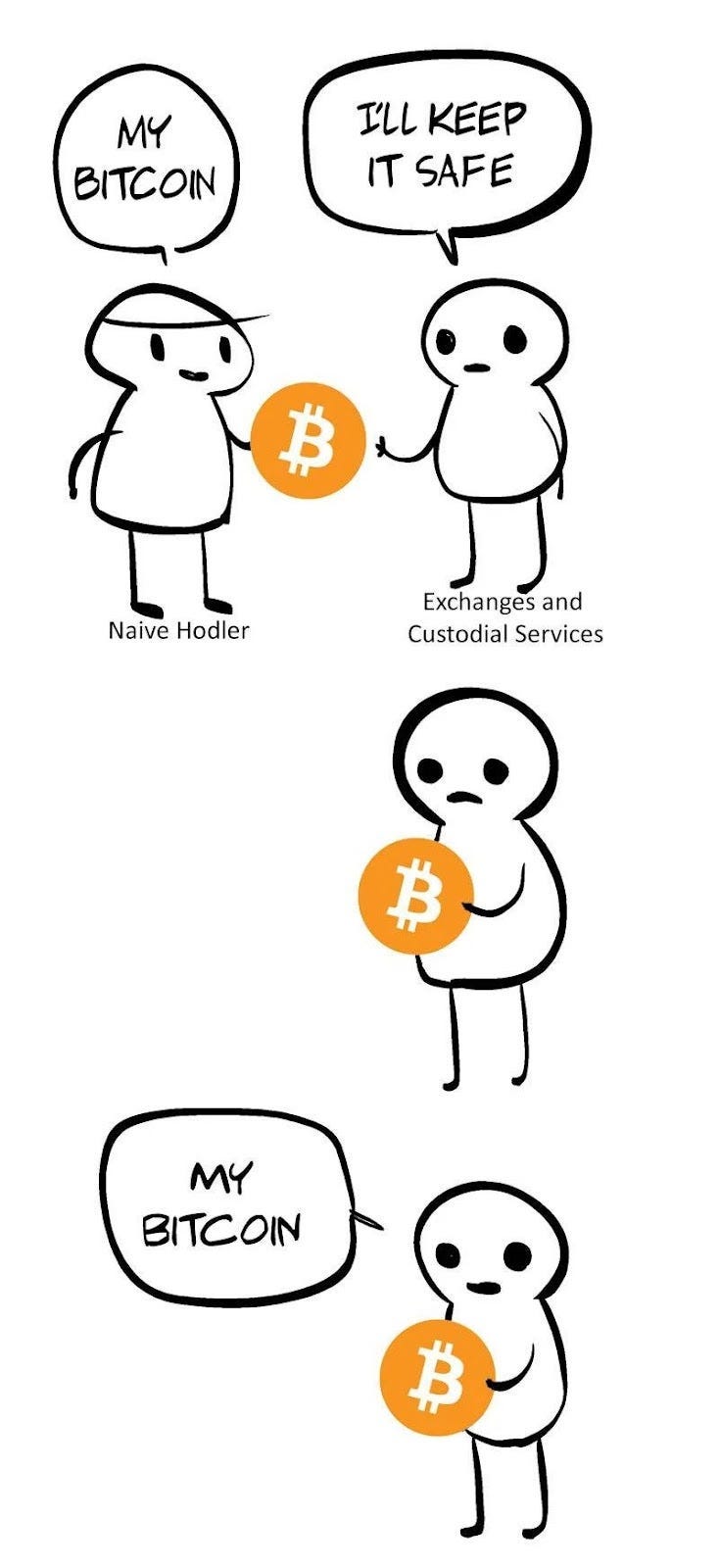

By now you’ve probably heard: “Not your keys, not your crypto”

But why is controlling your keys so important?

When you hold your private keys, you can access your assets directly on the blockchain without needing to rely on any third party. Giving you the ability to independently manage, transfer, and secure your cryptocurrencies.

By not being in control of your keys, there are several risks you are exposing yourself to:

Security breaches: Centralized platforms and exchanges can be targets for hackers and cybercriminals. If the platform suffers a security breach, your assets could be stolen.

Platform insolvency: If a centralized platform or exchange becomes insolvent, there is a risk that users may lose their assets.

Regulatory actions: Centralized platforms and exchanges are subject to regulatory actions and oversight. If the platform is shut down or restricted by regulators, you may lose access to your assets, at least temporarily.

Mismanagement: Centralized platforms and exchanges are operated by human teams, which can make mistakes or mismanage the platform, potentially leading to the loss of user assets.

Lack of control: When your digital assets are stored on a centralized platform or exchange, you don’t have direct control over your private keys.

Privacy concerns: Centralized platforms and exchanges often require users to provide personal information and identity verification processes (KYC/AML) to comply with regulations. Leading to reduced privacy, as personal information and transaction history may be stored by the platform.

In other words, by not holding your keys… you could be allowing this guy to get his hands on YOUR money:

There is a simple way to mitigate this risk… control your keys.

We will explore the popular solutions for crypto asset custody: non-custodial, third-party custodial services, self-custody via multi-sig, and MPC (Multi-Party Computation) Wallets.

Non-Custodial

A non-custodial wallet or service does not hold or control users’ private keys. Instead, users either hold their keys or interact with a decentralized system (such as a smart contract) that manages their assets.

Pros:

Users still have a degree of control over their assets

No reliance on a centralized entity to manage keys and assets

Reduced risk of loss due to platform hacks or mismanagement

Cons:

Users must still take responsibility for securing their private keys

May offer fewer features compared to custodial services

The level of control and security can vary depending on the specific non-custodial solution

Third-Party Custodial Services

Third-party custodial services are specialized companies that securely store and manage cryptocurrency assets on behalf of users or institutions. They cater to institutional investors, high-net-worth individuals, and others who require a higher level of security, compliance, and professional management for their crypto holdings.

Pros:

Advanced security measures and protocols

Insurance coverage for user assets

Regulatory compliance

Professional asset management

Cons:

Trust in third-party service

Fees for account maintenance and services

Limited privacy due to KYC/AML requirements

Limited control over private keys

Self Custody via Multi-Sig

Self-Custodial Multi-signature (multi-sig) wallets are a type of cryptocurrency wallet that requires multiple signatures (private keys) to authorize transactions and the user doesn’t give up the keys. They add an extra layer of security by distributing control of the assets among multiple parties, which can be individuals or entities.

Pros:

High security due to multiple signatures

Enforced rules/policies within organizations

Built-in backup mechanism

Trustless agreements and escrow services

Cons:

Higher complexity

Requires coordination among parties

Limited support and compatibility

MPC (Multi-Party Computation) Wallets

An MPC wallet is a type of cryptocurrency wallet that uses advanced cryptographic techniques to secure private keys and transactions. The main idea behind MPC wallets is to distribute the responsibility of managing private keys among multiple parties, making it extremely difficult for a single entity to compromise the wallet’s security.

Pros:

Enhanced security: The distributed nature of private key management reduces the risk of a single point of failure, making it more challenging for hackers to compromise the wallet.

Flexibility: MPC wallets can be designed with varying levels of redundancy and security, allowing users to balance convenience with security based on their specific needs.

Recovery options: Since private keys are split into shares, MPC wallets can provide more robust recovery mechanisms if a share is lost or a party becomes unresponsive.

Cons:

Complexity: MPC wallets use advanced cryptographic techniques, which may be more challenging for users to understand and set up than traditional wallets.

Increased coordination: Performing transactions with an MPC wallet requires collaboration between multiple parties, which could be slower and more cumbersome than using a single-party wallet.

Trust in participants: MPC wallets rely on the assumption that the parties holding the key shares will act honestly and securely. This requires a certain level of trust in the participants, which may not be suitable for all users.

Velvet Vaults

Velvet.Capital offers a unique vault system for its products, with each product having a separate vault created upon product inception. But the most important thing is Velvet.Capital never takes custody of user funds. So your funds stay your funds.

Fund Managers on Velvet.Capital can choose from three custody options:

Non-Custodial Vault: The underlying assets are stored in a smart contract vault, no one (not Velvet or the portfolio creator) has keys from the vault. The funds can be taken out only via the redemption module.

Self-Custody via Multisig: The underlying assets are stored in a Gnosis Safe vault (Gnosis is an industry-leading provider of multi-sig vaults). The keys can be held by the portfolio creator who will choose the owners + threshold when creating the safe (default) or transferred to the end clients (e.g., in the case of individual high-value users)

Third-party Custody: The underlying assets are stored with an external custodian, which has its own security guidelines and recovery mechanisms.

The purpose of Velvet Vaults is to provide a flexible solution that caters to a range of user requirements, preferences, and risk tolerances. The three options offered by Velvet allow clients to choose the level of control and security that best suits their needs.

If you are a fund manager and want to discuss in further detail the custody of your assets please visit our institutional investor website: https://velvet.capital/institutional

Velvet Does It Better

Because there is no one-size-fits-all solution for crypto asset custody. Each option has its pros and cons, and the choice depends on individual preferences, risk tolerance, and the specific needs of the user or organization. By understanding the differences between non-custodial, third-party custodial services, and self-custodial multi-sig, you can make a more informed decision about the best solution for securely managing and storing your cryptocurrency assets.

Interested in being a part of the next big thing in DeFi?

It’s been a busy year thus far & we accomplished a lot but we have more work to do! Our airdrop is coming up, we just launched an exclusive, high-utility NFT series, and our v2 is just weeks away! The time to join us is now.

We are backed by Binance Labs and other top Web3 and traditional funds and won hackathons & bounties at the BNB Revelation Hackathon, EthCC, EthIndia, EthNYC, Polygon Summer Hack, Ledger, Starknet Hack, and others. We are super pumped to bring DeFi to the next billion users!

Imagine what we can do if you join us? Let’s build the future of finance together!

Receive an exclusive report on the top holdings of whales in Crypto

We will send you this exclusive report when you refer 3 friends to the Velvet.Capital DeFi Newsletter!