If You Understand This... You'll Out Perform 90% of Retail Investors

Bitcoin - to this point - has been cyclical. How well do you understand the bitcoin cycles? Do you know how to capitalize on the cycles to buy low, sell high?

GM

Crypto is one of the most cyclical industries.

And sadly it takes the bear market for most to learn about the Market Cycles of cryptocurrency.

But, at least for now, it looks like we may be on the way up again.

Here’s a short summary where we’ll cover today:

· The Four Cycles

· Previous Bear Markets Compared to this One

· What Are Institutional Investors Doing

· Previous Bull Runs

· How To Prepare

· How Does Velvet.Capital Help You Achieve Crypto Investment Success

To read the full article visit: Understanding Crypto Market Cycles

The Four Phases of Cryptocurrency Markets

Accumulation Phase → Run-Up Phase → Distribution Phase → Run-Down Phase → Accumulation Phase

Accumulation: Begins when market bottoms and is characterized by low hype. Low volume and slow increase in price.

Run-Up Phase (Bull Market): Sentiment becomes and grows optimistic, FOMO starts. Volume grows and price goes up.

Distribution Phase: Top of the market, end of bull and start of bear market. Sellers begin to outweigh buyers and price begins to fall.

Run-Down Phase (Bear Market): Sellers drastically outweigh buyers. Toward the end of this phase sentiment is worst. Most new investors sell toward the end of this phase after buying in Run-Up or Distribution.

Which Phase are We In Currently?

BTC 2012–2016 Market Cycle

BTC 2016–2020 Market Cycle

BTC 2020–2022 Market Cycle

Looking back at previous cycles of Bitcoin, the market has topped in late 2013 (high of $1,160), 2017 (high of $19,500), and 2021 (high of $69,000).

After the 2013 top, bitcoin dropped 86% to lows of $150 over a 413 day period.

Following the 2017 top, bitcoin dropped 83% to lows of $3,200 over a 371 Day period.

So far after the 2021 top, bitcoin has dropped about 77% to its low. Currently we are trading at $19,400 429 Days after market highs.

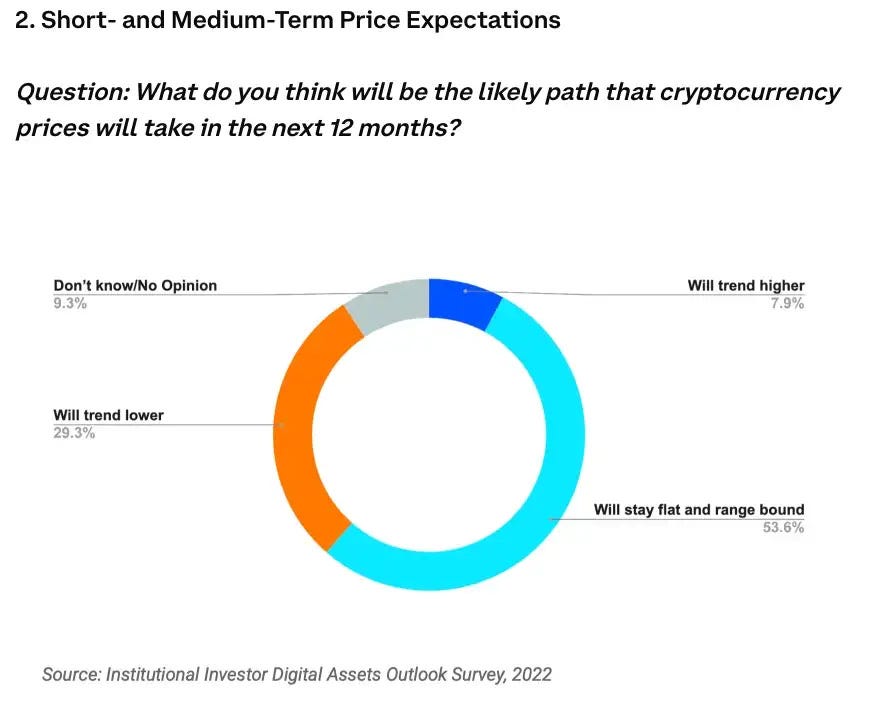

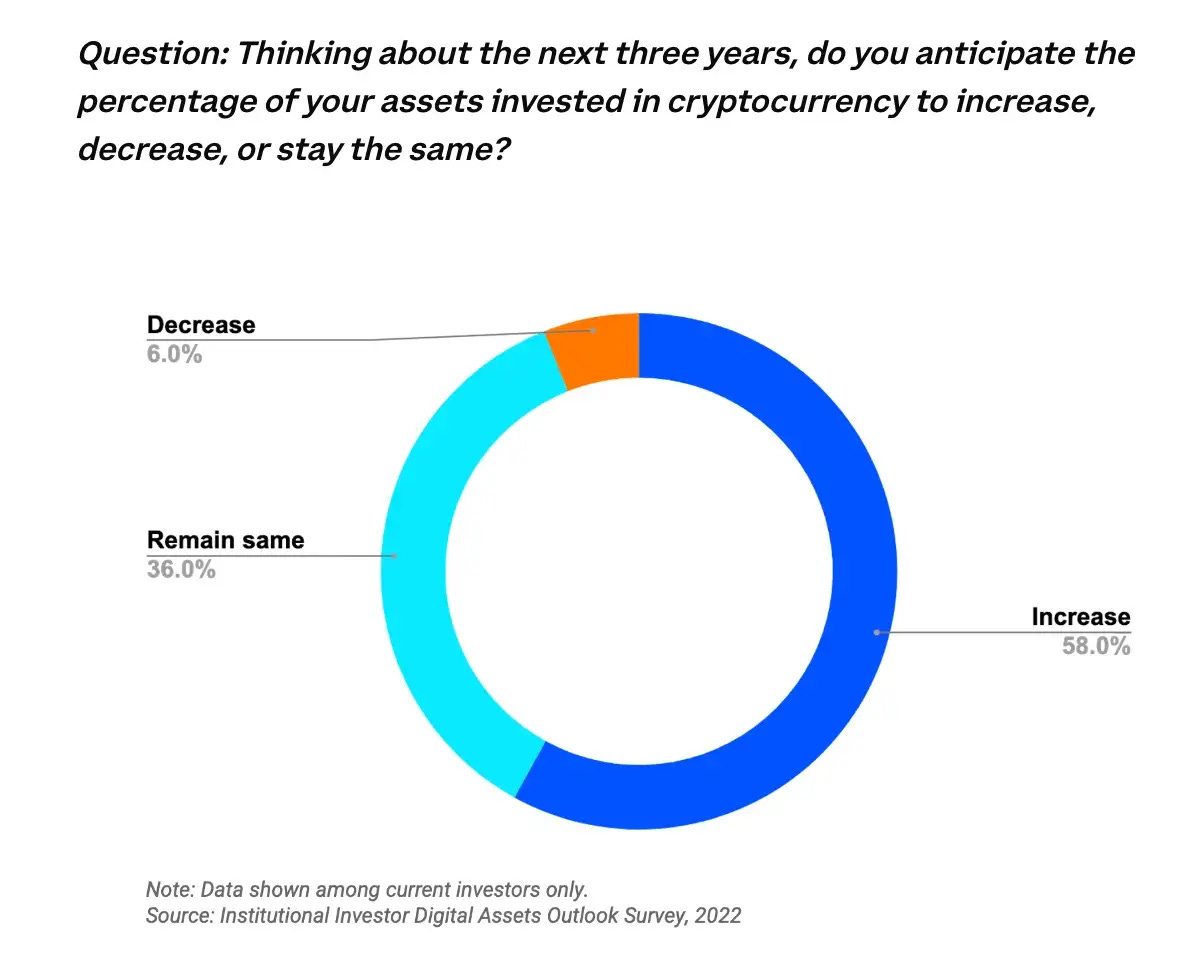

What Are Institutional Investors Doing

If institutions believed a massive drop in value for Cryptocurrencies was still to come and we weren’t at the very least approaching the end of the bear market, we would see more than 6% of them decreasing their Cryptocurrency allocation over the next 3 years.

Previous Bull Runs

BTC Accumulation & Bull Run Phases Early 2015 — Late 2017

BTC Accumulation & Bull Run Phases late 2018 — late 2021

Key Takeaways:

1. 3 Years Up → 1 Year Down

Bitcoin’s price tends to experience 3 years of price accumulation with 1 year of rapid price depreciation.

This is why leverage in cryptocurrency can wipe out many investors (FTX and 3AC both examples) because of the rapid price decrease.

2. Diminishing Returns

After the low in Early 2015, bitcoin’s price went up 11,612% (116x) to reach highs of $19,500 in late 2017. In the next cycle’s low in late 2018, 2,193% (21x) to highs of $69,000 in late 2021.

This is not unique to bitcoin. Over time, assets as they gain more market value over time tends have diminishing returns in each bull run.

How to Prepare for Crypto Market Cycles

To minimize the risk of making poor investment decisions based on market cycles, one reliable strategy is dollar-cost averaging.

If you are seeking to achieve higher returns, it is important to study the history of price action and gain a basic understanding of technical analysis to inform your investment decisions.

During the accumulation phase, it can be beneficial to increase your investments in order to take advantage of lower prices. In the run-up and distribution phases, it may be advisable to take profits and reassess your investment strategy.

How Does Velvet.Capital Help You Achieve Crypto Investment Success

Crypto investing can be hard but doesn’t have to be!

It is common for investors to enter or re-enter the market during the run-up phase, but by learning from the mistakes of others, you can avoid common pitfalls and make more informed investment decisions! Patience and discipline are key.

At Velvet.Capital, we believe in DeFi done right. We’re passionate about the transformational nature of DeFi and want to help onboard the next billion users into crypto. We help people create diversified crypto products with additional yield — all without giving up custody of their assets!

You can also easy deploy DCA strategies in your portfolio.

It is now easier than ever to start your crypto investing journey.

To read the full article visit: Understanding Crypto Market Cycles