Inflation Trends Diverge, Deutsche Bank Goes Crypto, CBDC Battle in Washington, and More!

Bitcoin goes renewable energy, SEC charges Stoner Cats, Zach Wilson NFT Soars, and more!

Market Landscape

In August, the pace of disinflation showed signs of slowing, with both the headline and core Consumer Price Index (CPI) moving in mixed directions. The headline CPI saw a 0.6% increase for the month, reaching a year-over-year acceleration of 3.7%, largely driven by higher energy prices, particularly a 10.6% rise in gasoline costs. Conversely, core CPI, which excludes food and energy, dipped from 4.7% to 4.3%, with a slightly higher-than-expected 0.3% monthly increase. Notably, the decline in used car prices continued for the third consecutive month, while airline fares increased due to higher jet fuel prices.

Despite the recent uptick in inflation, it’s important to note that this data does not significantly alter the disinflationary trend established earlier this year. The primary driver behind the recent acceleration in both consumer and producer prices has been higher oil prices, a well-understood factor that may not have long-lasting effects. The Federal Reserve’s focus remains on core inflation, and while the rise in energy costs warrants attention, the expectation is that as wage gains and housing inflation ease, core inflation will continue to moderate in the coming months and throughout 2024, although not necessarily in a linear fashion. The road could be bumpy but it is way too early to panic. As always it will be of paramount importance to continue to follow these macro-trends as we enter the year's end as they will undoubtedly be the driving forces behind both TradFi and crypto markets.

Quick Hitting Alpha

· The SEC charged the Stoner Cats NFT collection with conducting an unregistered offering of crypto asset securities, leading to a $1 million settlement for Stoner Cats 2 LLC, raising concerns about potential regulatory challenges for US-based NFT projects with common features like liquidity, project expertise, and royalty fees.

· Offchain Labs, the team behind Arbitrum, is partnering with Espresso Systems to integrate the Espresso Sequencer into the Arbitrum ecosystem, including the Timeboost transaction ordering system, to address MEV extraction challenges and promote decentralized participation.

· Germany’s largest investment bank, Deutsche Bank, has partnered with Swiss-based digital asset infrastructure provider Taurus to offer crypto custody and asset tokenization services, following its previous investments in Taurus and application for a crypto custody license.

· Bloomberg analyst Jamie Coutts reports that over 50% of Bitcoin mining now relies on renewable energy, largely due to miners relocating from China following the country’s 2021 ban on crypto mining.

· Polygon has unveiled three Phase 0 proposals outlining its ambitious 2.0 overhaul, including plans to replace MATIC with a new token named POL, establish POL as the primary network and staking token across the Polygon ecosystem, and introduce a new staking layer for Polygon networks as competition in the Layer 2 space to scale Ethereum intensifies.

· A $2.5 million loan on Aave v2, backed by ZRX, is at risk of liquidation due to a shortage of on-chain ZRX liquidity, potentially leaving the protocol with bad debt and prompting Aave to consider selling AAVE tokens staked in its safety module as a remedy after experiencing $1.6 million in bad debt last year.

· Deutsche Bank, Germany’s largest bank with $1.4 trillion in assets under management (AUM), is partnering with Swiss crypto firm Taurus to provide institutional clients with crypto custody services, enabling the bank to hold cryptocurrencies and tokenized traditional assets for its corporate customers.

· Ashton Kutcher’s Stoner Cats NFT collection faced SEC scrutiny for distributing unlicensed securities but settled for $1 million on the same day, amid ongoing criticism of the SEC’s regulatory approach to the crypto sector, following a similar $6 million settlement with media company and NFT issuer Impact Theory.

· Sony’s subsidiary, focused on AI and IoT, is partnering with Startale Labs to introduce the Sony Chain blockchain, aiming for it to serve as a foundational element of global web3 infrastructure, potentially supporting applications beyond Sony’s scope, amid growing mainstream interest in the crypto market, with companies like PayPal, Nubank, and BlackRock making moves in the space.

· Telegram has added a self-custodial crypto wallet called TON Space, built on The Open Network (TON) blockchain, enabling its 800 million monthly active users to securely store and manage digital assets.

In The News

One Year After the Merge: Where Does Ethereum Stand?

A year ago, Ethereum shifted to proof of stake, drastically reducing energy consumption and environmental concerns. Staked Ethereum has nearly doubled, reaching 26.5 million ETH worth $43 billion. However, concerns about centralization, particularly with Lido’s dominance, have emerged. Ethereum’s scalability issues persist, but layer-2 solutions are growing rapidly, with over 61 million transactions on popular networks. In the U.S., staking has sparked regulatory issues, with the SEC pursuing exchanges, while debates over Ethereum’s classification continue, leading to a jurisdictional dispute between the SEC and CFTC.

The Bankless Guide to MetaMask

MetaMask, a popular Ethereum wallet and browser extension, has evolved since its 2016 launch. It now supports multiple browsers, boasts a mobile app, and offers a decentralized exchange, bridge aggregator, on-ramp for crypto purchases, and ETH staking. Its user base has skyrocketed, with 30 million monthly active users as of March 2022, solidifying its status as a top crypto application.

Latest CFTC Enforcement Actions Challenge Core Tenets of DeFi

The recent enforcement action by the US CFTC against DeFi protocols Opyn, 0x, and Deridex has sparked debate among crypto advocates about the regulatory landscape. Critics point out contradictions, such as a court ruling in the Risley v. Uniswap case that found developers not liable for third-party misuse of their software, conflicting with the CFTC’s actions. Inconsistencies within the CFTC itself, including a proposal for supervised experimentation in digital assets and a commissioner’s dissenting statement, further complicate the matter. The regulatory uncertainty in the crypto space continues to evolve, with some acknowledging that some degree of regulation is inevitable.

Dueling Digital Dollar Bills Debated in Congressional Hearing on U.S. CBDC

Several House bills are being introduced to address the issue of a CBDC in the US. While some Republican lawmakers strongly oppose the idea, Democratic Rep. Stephen Lynch has reintroduced a bill calling for a digital dollar pilot program. The House Financial Services Committee held a hearing on the implications of a government token, although there is no clear indication of the Biden administration’s stance on the matter. Lynch’s ECASH Act proposes a Treasury Department pilot program to develop a digital US dollar that would complement a potential Fed-issued CBDC. Meanwhile, other Republican bills aim to ban CBDCs and prevent government testing of them. The debate over CBDCs continues, with differing opinions on their feasibility and purpose in the US regulatory landscape.

Aaron Rodgers Injury Sends DraftKings NFTs Soaring for Backup QB

After New York Jets’ quarterback Aaron Rodgers got injured, backup Zach Wilson’s fantasy football NFTs on DraftKings’ Reignmakers platform surged in value. Wilson’s limited edition NFT initially sold for $69 to $99 but quickly jumped to $400 after Rodgers’ injury. By the end of the game, the NFTs were listed for as high as $555, with recent sales at $285. This shows how NFT values can swiftly change based on sports events, reflecting their connection to an athlete’s performance. DraftKings’ NFL Reignmakers lets users create fantasy football teams and win prizes, including NFTs, based on NFL player performance, with $30 million worth of prizes this season.

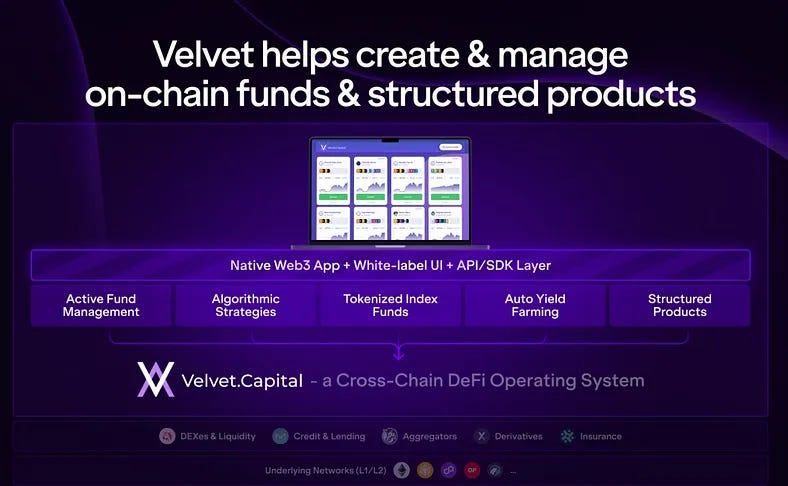

Institutional-Grade DeFi For Everyone

Crypto can be hard. DeFi can be even harder! But it doesn’t have to be!

At Velvet Capital, we are building the world’s first institutional-grade, omnichain DeFi asset management operating system! Anyone will be able to seamlessly launch and manage on-chain funds — in just a few clicks. Crypto portfolio management like never before!

We help people create diversified crypto products with additional yield — all without giving up custody of their assets! No matter your level of expertise — we got you covered!

Join Velvet DAO Today!

Join the Velvet Family! Top web3 builders, giga-brains, fund managers, & investors await you in Velvet DAO!

Follow us on Twitter, LinkedIn and join us on Discord & Telegram for more updates! We want to hear from you, don’t be shy.