Introducing the Hardcore Labs Stable High-Yield Portfolio: Earn 15-20% on Stables

High-yield. Curated by veterans. Live now on Velvet.

If you’ve been sitting on idle stables or cycling through low-yield portfolios, this one’s for you.

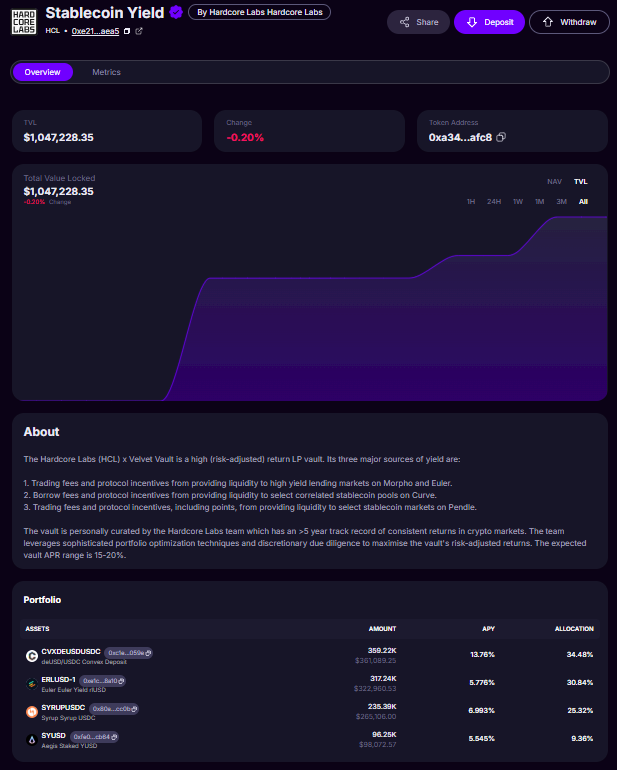

We’re excited to announce the launch of the Hardcore Labs x Velvet Stablecoin Yield Portfolio, a battle-tested, actively managed DeFi strategy designed to generate 15–20% APR in stablecoins, curated by the team at Hardcore Labs.

This portfolio combines yield farming, protocol incentives, and structured DeFi strategies into one seamless product.

All the complexity? Abstracted.

All the noise? Filtered.

You just deposit, and the portfolio does the rest.

Deposit into the Hardcore Labs Portfolio

What Is the Hardcore Labs Stablecoin Yield Portfolio?

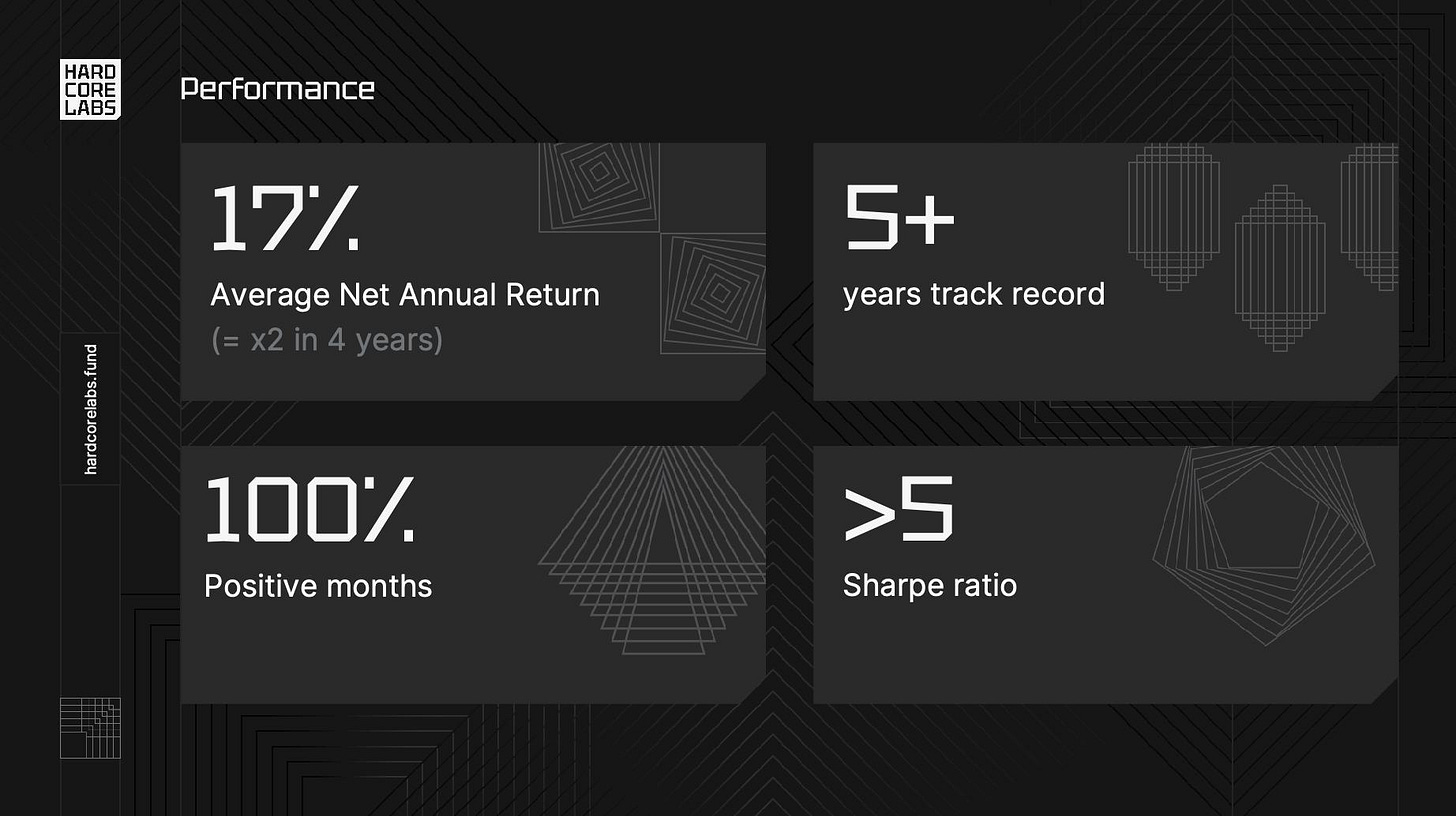

The Hardcore Labs portfolio leverages a multi-layered yield approach that taps into multiple DeFi primitives, boosts, and point metas - optimized by a team with over 5 years of experience navigating crypto markets.

Here’s how it earns:

1. Lending Yield

Earn borrow fees and protocol rewards by providing liquidity to optimized lending markets with isolated risk, boosted APYs, and peer-matching.

2. Stablecoin Pool Yield

Provide liquidity to correlated stablecoin pools, boosted with veTokenomics (CRV, CVX, SDT) and earn trading fees + incentives.

3. Yield Trading

Earn from tokenized yield markets, with exposure to future yield, principal token trades, and points-based rewards.

This strategy is actively managed - not passive farming - and constantly rebalanced based on where the best risk-adjusted returns exist.

Deposit into the Hardcore Labs Portfolio

Who Is Hardcore Labs?

Hardcore Labs is a veteran DeFi team with a strong track record in yield strategies, capital preservation, and risk-adjusted alpha.

With experience across CeFi, DeFi, and structured products, they bring:

Professional-grade portfolio optimization

Smart risk management

Opportunistic rebalancing

Deep protocol integrations

Now, they’ve partnered with Velvet to bring their flagship stablecoin yield strategy onchain and accessible to all.

Protocols That Will Be Used For Yield

Aegis

Aegis YUSD: a Bitcoin-backed, delta-neutral stablecoin offering real-time transparency, built-in yield generation, and complete independence from the fiat banking system.

Reserve monitoring done by Accountable. Security audits completed by Hacken and Sherlock.

Latest updates:

Broke 30M in TVL (https://app.aegis.im/transparency)

10M+ locked on Pendle Pools - one of the leading PTs on the platform.

Listed on Euler, Spectra, Mellow & other markets. Curation by K3, Re7, MEV & more

Users of this portfolio receive 3x Aegis Points, making you early to one of DeFi’s most promising risk primitives.

Morpho

An open, peer-matched lending protocol that enhances rates by directly matching borrowers and lenders, all while inheriting security from major money markets like Aave and Compound.

Euler

A next-gen money market with permissionless asset listings, isolated risk, and dynamic rates. Euler supports long-tail assets while minimizing systemic risk — ideal for diversified yield strategies.

Pendle

A yield trading protocol where future yield is tokenized and tradable, letting people trade, farm, hedge future APY.

Curve

The foundation of stablecoin liquidity in DeFi — low-slippage, high-volume AMMs for correlated assets and synthetic pools. Also supports lending via LLAMMA (soft liquidations).

Convex

Maximizes rewards for Curve LPs without locking CRV directly. Convex is a must-use to access boosted emissions and influence Curve governance.

Stake DAO

A governance and yield automation platform focused on monetizing veTokenomics. It provides additional reward wrappers and yield strategies on top of Curve and Convex.

Bonus Rewards for Depositors

When you deposit into the Hardcore Labs Stable Yield Porfolio, you’re not just earning passive income — you’re stacking high-value points across ecosystems:

3x Gems (Velvet Points)

Gems are Velvet’s loyalty and airdrop system

Every day you hold, you earn Gems — and each month, they convert to $VELVET

In Epoch 2, users earned over $95,000 worth of $VELVET

This portfolio offers a 3x multiplier on TVL-based Gems so your rewards stack faster

Read more about how Gems convert to $VELVET

3x Aegis Points

Aegis is building the DeFi credit layer of the future

Portfolio users earn 3x the standard Aegis Points

These may unlock future access, governance, score boosts, or more

Portfolio Yield: 15–20% APR (Net)

The current projected range is 15–20% APR, net of fees and inclusive of protocol rewards and point-based incentives — all optimized through weekly rebalancing and discretionary yield farming.

This is real, sustainable, and actively managed yield — not unsustainable emissions or leverage loops.

Ready to Start?

The Hardcore Labs Stable Yield Portfolio is live now on Velvet. It’s the easiest way to put your stables to work, with a team and strategy you can trust.

Deposit into the Hardcore Labs Portfolio