Is Crypto a flight to safety from the Banking System?

SVB due to the unprecedented rise in interest rates, fractional reserve system, improper hedging, and clever accounting failed and emphasized the risk in the banking system.

GM

It’s been a crazy few weeks in both Crypto and Banking, and if you’d like to know what happened to SVB, how the government is reacting, and what this means for Crypto… keep reading.

We’ll cover:

The Macro Economy

What Happened to SVB: Clever Accounting, Lack of Diversification, and Lack of Hedging

Concern For Government’s Bailing Out Depositors

Crypto Outlook During The Banking Crisis

Read the full article: SVB, Banking Crisis, & Crypto as a Hedge

The Macro

Since 2008, the technology industry has experienced a rapid expansion.

This success was propelled in large part by easy money policies and artificially low-interest rates (almost zero).

However, recently, things have started to shift as these companies continue to feel increased pressure from rising rates and persistent inflation.

S&P Composite Index Past 10 Years

One of the biggest winners in banking from the Tech Boom was Silicon Valley Bank. Due to its established presence in Silicon Valley, California spanning four decades; the bank emerged as a leading banking institution for technology companies and startups both nationally and globally.

When Technology boomed in 2020, SVB experienced a significant inflow of deposits as its depositors expanded, and the private venture capital market surged, with numerous firms attaining all-time high valuations year after year.

Given their influx of cash, SVB had to find ways to invest their deposits to make money.

They decided to buy “low-risk” US Treasury bonds (Which is what most banks do with their cash deposits). At the time, interest rates in the US were low and around 0%. So the yield on long-duration treasury bonds ranged from .2% to 1% during 2020.

In 2022, the US Federal Reserve started aggressively raising interest rates to mitigate inflation. At the time inflation was between 7% and 9% year over year from December 2021 to November 2022, and the Fed’s goal is 2% annually.

This lead to a significant decrease in the value of SVB’s long term bonds, that they held.

So why did this decrease the value of their previously owned treasury?

When selling a treasury bond before its maturity date, investors will typically pay the current market rate for similar bonds, which in turn determines the bond’s value. For instance, if the current rate for a particular type of bond drops to 1%, investors may only pay 80% or 90% of the bond’s face value, causing the bank to suffer a loss if it must sell the bond at that time.

SVB held a significant amount of low yield treasuries, that decreased in value.

SVB Clever Accounting

SVB held HQLA (High-quality Liquid Assets) Investments that can either be booked as AFS (Available For Sale) or HTM (Held To Maturity) for accounting purposes.

AFS: Unrealized gains/losses don’t show up on the P & L Statement of the bank, but they do show up in their capital positions.

HTM: Unrealized gains/losses do not show up on the capital positions.

SVB held $91B in HTM securities and only $26B in AFS.

Lack of Hedging Against Interest Rates

One approach to mitigate the risks associated with bonds in a portfolio is to use interest rate hedging for those intended to be held until maturity. This is a best practice for banks looking to minimize their risk exposure.

Although interest rates had increased considerably between 2021 and 2022, SVB reduced their interest rate swaps (which are employed to hedge against interest rate risks) during this period.

The most likely reason for not hedging against interest rates was to optimize profits. When a bank hedges against interest rate risks, they must pay a fee, which reduces the yield on their bonds that are already earning a low yield.

Concern For The Government Bailing Out Depositors

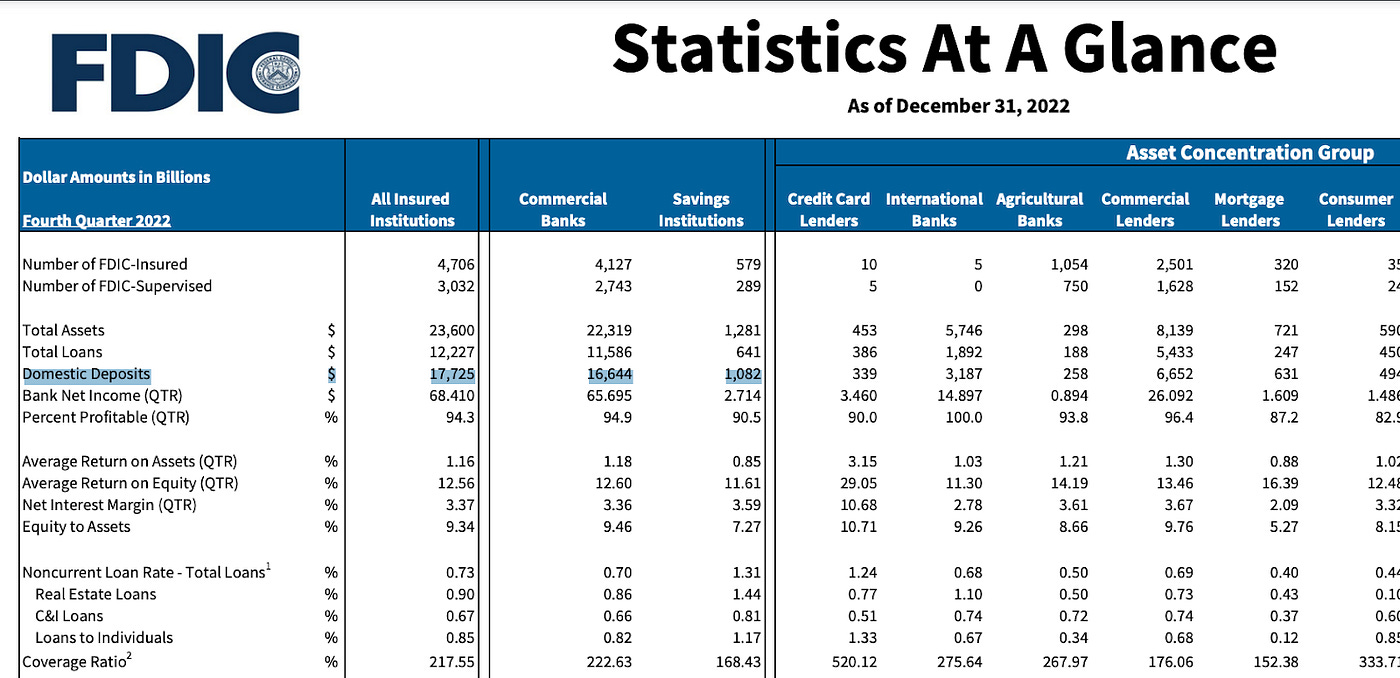

One concern regarding SVB’s depositors is the possibility of being bailed out for an unlimited amount, exceeding the $250k FDIC insurance coverage. The scale of the loans needed to provide liquidity to banks in such a scenario is substantial. In the US, insured banks currently hold around $17 trillion in deposits.

In the past week, the government had to intervene to prevent bank runs, resulting in the injection of $297 billion in assets to provide the required liquidity to the banks.

The fear is that this $297 Billion could continue to grow if there are more banks to fall due to bank runs, and we’ve already seen multiple failures with Silvergate, Silicon Valley Bank, Credit Suisse, and Signature Bank.

What could governments do?

One solution that’s being thrown out there that governments may do to combat the banking failures.

This would increase the value of the bonds that banks currently hold and decrease the unrealized losses on their HTM securities.

The issue with this solution is, of course, inflation.

So the government has two options:

1: Combat inflation and stay the course with interest rates: This will cause more banks to possibly fail, and likely force the government to fund future bailouts by printing more money or taxation. This will also cause more people to lose faith in the banking system and possibly more bank runs and failures.

2: Lower Interest rates: This will cause more inflation (which the US is already at 6.5%) and will increase the value of the bonds on banks’ balance sheets.

Talk about being stuck between a rock and a hard place! It might be time to start growing your crypto portfolio with Velvet.Capital.

What does this mean for Crypto?

After the SVB collapse bitcoin was at $20,000, but since then the price has jumped to over $28,000 as of Sunday. The rest of the market has been moving too. Still, this rally has been dominated by bitcoin (with dominance rising from 42% to 45.5%) as people search to find alternative ways to store money away from the banking system.

Crypto, specifically Bitcoin, is often viewed as a hedge against inflation and economic turmoil due to its decentralized nature and limited supply. BTC provides an alternative to the banking system as it was created by Satoshi on the back of the 2008 Financial Crisis, where banks taking on high-risk leveraged positions on Mortgage Backed Securities.

Bitcoin is not controlled by any central authority and has a fixed supply of 21 million coins that can ever be mined. This means that Bitcoin is not subject to the same inflationary pressures that fiat currencies face when governments print more money, which can lead to a decrease in the purchasing power of a currency.

Stablecoins are cryptocurrencies that are pegged to the value of a specific asset, such as the US dollar, which allows them to maintain a stable value despite fluctuations in the broader cryptocurrency market.

DeFi platforms offer a decentralized alternative to traditional financial services, such as loans and savings accounts, which can provide more stability and security during economic uncertainty.

Receive an exclusive report on the top holdings of whales in Crypto

We will send you this exclusive report when you refer 3 friends to the Velvet.Capital DeFi Newsletter

Like NFTs? Become a Founder Today

We are excited to introduce the Velvet Founders Club NFT Project as a way to acknowledge and reward our initial supporters, while also expanding our community by welcoming new members. Everyone is invited to join the Velvet Fam. By possessing this unique NFT, you will receive exclusive perks, actively contribute to the growth of Velvet DAO, and establish your status as an original member of our community.