Making DeFi Work For You!

Understanding one of the biggest trends of the next decade.

The Velvet.Capital Mission & Vision

Bring financial independence- free of intermediaries and centralized parties- to the next billion crypto users & become the #1 multi-chain platform to manage digital assets.

A $200 Billion Opportunity w/ More Growth to Come

According to DeFiLlama, the total value locked in DeFi protocols is over $200 billion which represents truly parabolic growth from May of 2020. That value is derived from all deposits locked in the form of cryptocurrencies for lending, staking, liquidity pool, etc. The chart is impressive and in many ways speaks for itself but it’s important to remember that the true opportunity is magnitudes larger.

Our current financial system is ripe for innovation as it hasn’t really systematically changed since the industrial revolution. Many of the innovations we have seen over the last few decades are merely superficial retrofits. The “innovation” in Fintech was coming from the UI/UX or data aggregation, but the core legacy banking systems stayed the same for decades. DeFi is a true reconfiguring of the systems and structures of the financial system at its deepest levels.

As DeFi continues to grow it will have the opportunity to disrupt so many sectors- consumer banking ($2.3T), insurance ($6T),traditional capital markets ($100T), and many more. That’s a huge opportunity and one that you should keep on your radar as DeFi continues to grow & mature.

DeFi Lowdown

Decentralized finance, or DeFi, refers to an emerging class of decentralized applications (think like apps on your phone but created through smart contracts) that aim to recreate traditional financial instruments using web3 tech stack (i.e., built on top of blockchain). It’s essentially peer 2 peer finance — free of middlemen, gatekeepers, or controlling governments and governed by clear programmed rules (smart contracts). No funny business allowed! With DeFi it will be possible to take out loans, exchange value, earn yield, borrow assets, join liquidity pools, mint stablecoins and even more uses will emerge as innovation continues.

Core Tenants:

Permissionless (openly accessible to anyone)

Programmable (fully automated by smart contracts)

Transparent (traceable and trackable to a public ledger)

Immutable (unchangeable)

Non-custodial (no one can freeze or seize your assets)

Real Life (D’)Applications

As an anchor point, consider this: according to Dune Analytics, there are currently over 4 million unique addresses (think of this as a proxy for users) using DeFi applications — that’s a growth of over 40x in just the last 2 years. Wow! There are also over 10,000 DApps- a number that is growing too. It’s still early but you get how this story is going- as time goes on adoption will increase and these sorts of applications will become more and more mainstream. DApps are innovating not just in finance but also in gaming, property, security, marketplaces and media.

For users DeFi applications are similar to regular web or mobile applications, but they are built with smart contracts. For example, with DeFi lending, users can borrow cryptocurrency, like with a fiat currency at a bank, or lend it to earn additional interest. That’s right you now have that power, it is not solely reserved to banks or the ultra-wealthy.

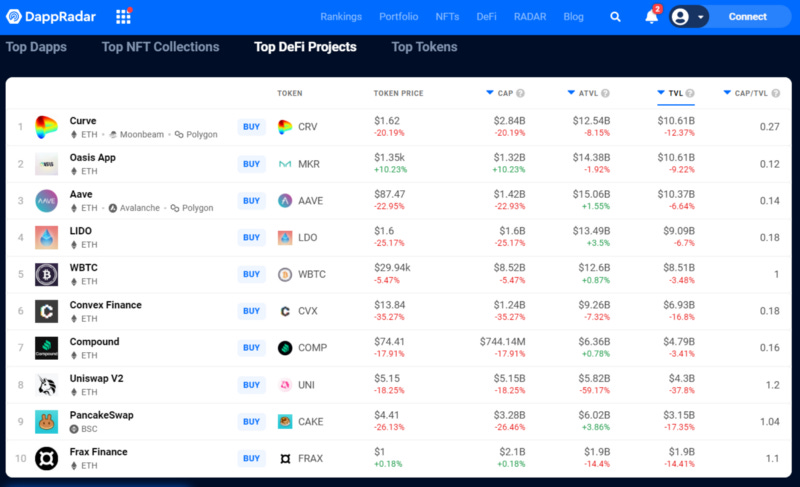

Interest fluctuates depending on the supply and demand at the time, and borrowers must provide collateral (w/ other crypto-assets) but the process is permissionless, programmable, transparent, immutable and non-custodial so it’ll be easier and less expensive than going through a more traditional channel. There are 178 active DeFi projects listed on DappRadar and that number figures to continue to grow.

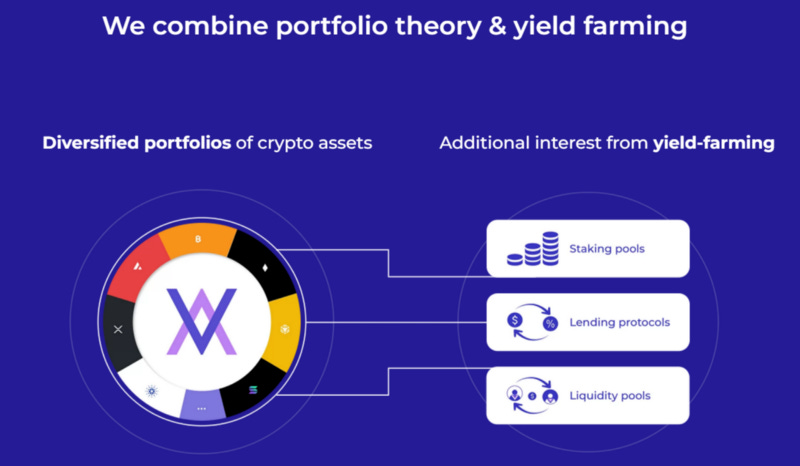

Future of Crypto Asset Management

With Velvet.Capital, a multi-chain DeFi protocol, users can create all kinds of thematic, crypto portfolios, indexes & other financial products with additional yields. All in just a few simple clicks. You can make your own or have one generated for you. The possibilities are endless. We utilize modern portfolio theory and yield farming to improve risk-reward profile & amplify your returns. We build with the future in mind so you’ll be able to benefit however the market grows.

The multi-chain future (Binance, Ethereum, Terra, Polygon, Avalanche, Fantom, etc.) is coming as users search for more cost-efficient ecosystems with cross-chain features. The days of Ethereum totally dominating are over. This can be illustrated in the chart above that shows the TVL growth of Terra, Polygon, Binance in the last 18 months. You’ll be able to best take advantage wherever the trends go with Velvet.Capital.

You don’t need to spend time researching different cryptocurrencies, making trades and managing your portfolio yourself — we got you covered. Velvet.Capital provides a secure and intuitive platform for anyone — including: individuals, professional asset managers and treasury managers alike. Not to mention the tax savings structure we can offer!

The use cases for DeFi are going to expand and grow as the technology matures but some worth mentioning use cases are: for compliance & KYT purposes (know your transaction purposes)- meant to prevent money laundering/ other illicit activity, improved data analytics- making better decisions from a more transparent and wide pool of data, and insurance- protecting your assets with smart contract centric insurance solutions.

Frictionless

Aside from some of the more obvious benefits of DeFi- that come with the immutability, the transparency and trackability, the permissionless nature, the programmability, and the control you have over your own assets- it’s totally frictionless. When you remove the layers of gatekeepers & intermediaries, the red-tape and bureaucracy; you create a streamlined and seamless experience that keeps people much closer to their desired outcomes- meaning you maintain a high level of control. Your future is back in your own hands.

The horrible fees, paperwork, lag times in processing requests, the incompetence- gone! Imagine all the synergies that come from savings on fees, administrative costs, regulatory hurdles, time, energy and worry! You no longer have to rely on banks, governments, regulatory agencies, etc. to get stuff done. Just you, your desired outcome and a smart contract. All from your phone or computer. Voila!

Early Sign-Ups get Access to Governance Token Airdrop

This is just the beginning for Velvet.Capital and DeFi. It’s time to take back control of your assets and financial future. Join us on this journey and be part of the DeFi revolution. If you sign up early you’ll get whitelisted for our governance token airdrop and exclusive perks & rewards.

Check out our flagship site to sign-up and get more info.

Don’t forget to join our community on Discord & follow us on Twitter, Instagram, LinkedIn & Telegram for more updates! We want to hear from you, don’t be shy.

Until next time,

Cheers!