Newest & Hottest DeFi Investing Products

Salutations Frens! We have new products that we think you’ll love. Check out the newest DeFi products offered at Velvet.Capital!

Salutations, Velvet Underground (That’s you- our OGs. We’re calling you that now…you’re hearing it here first)!

Just when you thought it couldn’t get any better, we have some ‘new hotness’ for you, fresh off the presses — new portfolio products to be exact. You can learn about our first three products here. These new ones are similar, just differently weighted.

We can’t help ourselves, we love DeFi and want to share it with the world. Our cross-chain, DeFi asset management protocol is going to revolutionize DeFi by making it simpler, sleeker, and safer than ever before! Anyone can invest like a pro, with Velvet.Capital!

Our Products

Keep in mind our protocol is built with the long-term in mind. We will be constantly adding new products and building out functionality. Eventually, you will be able to deploy any type of portfolio and strategy on-chain, with Velvet.Capital. We’re committed to offering unparalleled flexibility, customization, and diversification.

Have an idea for a product you’d like offered? Tell us and we’ll build it :)

Blue Chip (MCap) Portfolio

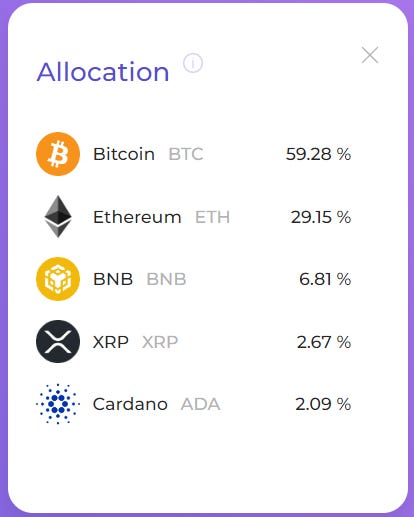

The “Blue Chip Market Cap” Portfolio is a portfolio of the Top 5 cryptocurrencies by market cap, excluding stablecoins. This portfolio is weighted proportional to its percentage of Market Capitalization.

Holdings: Bitcoin 60%, Ethereum 30%, Binance 6%, XRP 2%, Cardano 2%

Why would I buy the Blue Chip Portfolio?

This portfolio makes it easy for any investor, novice or savvy, to enter the market with relative ease. Unlike its weighted predecessor, this index is more reflective of market sentiment. Meaning, you emphasize the top coins (BTC, ETH), while still getting some upside and diversity from the other 3.

In equity terms, this portfolio is the equivalent of having an Index of Amazon, Apple, Microsoft, Google, and Saudi Aramco (the five largest companies by market cap in the world).

Holdings:

Bitcoin: BTC (60%)

The first cryptocurrency ever created with a market cap of $372 Billion. It’s a Proof of Work currency with a 21 Million total supply (about 2 million left to mine) and goes through a halving of mining rewards of new tokens every 4 years. So far, bitcoin jumps in price have all been around the halving (2012/13, 2016/17, and 2020/21).

Bitcoin is still the most widely known Cryptocurrency and most people who buy crypto tend to start with bitcoin.

Ethereum: ETH (30%)

Second largest Cryptocurrency with a market cap of $160 Billion. ETH is the cryptocurrency that powers the Ethereum network, an open-source decentralized computing platform with smart contract functionality (why you can make dApps, DeFi Protocols, and NFT’s). ETH recently underwent “the merge” in September to become a Proof of Stake (PoS) Blockchain.

Binance: BNB (6%)

BNB is the exchange token of the Binance Crypto Exchange. Originally it was launched as an ERC-20 asset on the Ethereum Blockchain, but has now moved to the Binance Smart Chain (or BNB Chain). The BNB token gives owners discounted trading fees, can be used for payments, and investing in new ICO’s on the BNB Chain.

Cardano: ADA (2%)

ADA is the cryptocurrency powering the Cardano blockchain, an open-source PoS Blockchain. ADA’s current market cap is $14 Billion. Cardano was founded by ETH co-founder Charles Hoskinson and is a competitor. Cardano focuses on slow development and scientific papers, often making investors unhappy with the slowness of the blockchain's development.

Ripple: XRP (2%)

Ripple is a ‘Money Transfer Network’, and XRP is their native Cryptocurrency and currently has a market cap of $23 Billion. Ripple XRP is an open-source and decentralized blockchain aimed at reducing friction in the financial system with fast transaction speeds and low costs. The Ripple XRP Blockchain also is developing smart contract functionality to compete more with Ethereum.

Market Cap Top 10 Portfolio

Our Top 10 Portfolio is a similar idea to the Blue Chip Portfolio, however, instead of the Top 5 at a 20% weight, it gives you a 10% weighting to each of the Top 10 cryptocurrencies by market cap, excluding stablecoins. This portfolio is equally weighted and rebalanced once every two weeks.

Holdings: BTC (56%), ETH (29%), BNB (6%), XRP (2%), ADA (2%), DOT (1%), MATIC (1%), TRX (1%), AVAX (1%), UNI (1%)

This portfolio provides a higher upside than the Blue Chip given the higher volatility in lower cap assets than large caps like bitcoin and Ethereum, but still gives you allocation in the big projects.

Holdings:

Polkadot: DOT (1%)

DOT is the native asset to the Polkadot network is an open-source protocol that currently has a market cap of $7 Billion. Polkadot facilitates cross-chain transfers of data and assets. Polkadot is aiming to bring us into a multi-chain world by processing transactions on a few different blockchains.

Polkadot allows developers to launch chains and applications leveraging a shared security model, without needing to worry about attracting enough miners/validators to secure their own chains. Additionally, Polkadot’s parachains can use bridges to connect with external networks like Bitcoin and Ethereum.

Tron: TRX (1%)

TRX is the native asset of Tron, a decentralized, open-source blockchain with smart contract functionality. It’s a Proof of Stake blockchain focused on the development of dApps due to their high transaction throughput and low transaction fees. TRX has a market cap of $5.5 Billion.

Polygon: MATIC (1%)

Polygon is a Layer 2 Ethereum Scaling Solution that allows developers to create dApps with low transaction costs and solves the high gas fee problem on the Ethereum Blockchain. MATIC can be staked to earn additional yield and secure the Polygon Network. The current market cap of MATIC is $6.7 Billion.

Avalanche: AVAX (1%)

Avalanche is an open-source layer 1 blockchain competitor of Ethereum focused on transaction speed and scalability. The Avalanche blockchain can process about 4,500 transactions per second, making it one of the fastest blockchains. AVAX is the native cryptocurrency of the Avalanche Blockchain. AVAX’s current market cap is $5 Billion.

Uniswap: UNI (1%)

Uniswap is a DEX (Decentralized Exchange) that operates on the Ethereum Blockchain. UNI is the governance token of Uniswap and is used to vote on all protocol changes. The UNI token itself does not give you the right to any profits. Uniswap is the largest DEX by trading volume and has a market cap of $4.9 Billion.

Start Investing Now!

Early adopters and supporters will be rewarded! Token launch and NFT launch coming soon!

Getting Started Demo

To get started go to https://velvet.capital/ and click the “Launch App” button on the home screen. This should redirect you to https://app.velvet.capital/.

Full tutorial here: https://medium.com/@velvetcapital/defi-asset-management-getting-started-with-velvet-capital-7bc24697e687

Join the Velvet Fam!

Don’t forget to follow us on Twitter, LinkedIn and join us on Discord & Telegram for more updates! We want to hear from you, don’t be shy.

Let’s build together!

Until next time,

Cheers!

New to trading? Try crypto trading bots or copy trading