Revenge of the Bull

After a tough 2022, crypto's recovered well this January. It seems the worst may now be behind us.

Greetings Velvet Fam!

Four weeks into January and 2023 is off to a bang. Crypto assets are seeing a boost in the new year as various factors converge to create a more optimistic outlook for risk assets. Not to mention, the uncertainty caused by the implosion of FTX has decreased as the dust continues to settle, lowering the overall FUD for the crypto sector.

Broader economic headwinds such as inflation and the efforts to curb it are potentially shifting. There are indications that inflation in the US has peaked and is decreasing and that interest rates may soon stop rising, with even the possibility of cuts by the end of the year. All this while the economy stares down the barrel of a possible (Federal Reserve-induced) recession.

2023 will undoubtedly be a wild ride! At Velvet.Capital, we understand the fast-paced nature of the crypto markets. Our goal is to provide our frens with valuable insights and the top news from the crypto-sphere- and have some fun along the way!

Now let’s jump into some news!

Quick Hitters

· Binance announces plans to increase staffing by 15–30%.

· FTX already recovers over $5B in customer assets:

· House Republicans are forming a congressional group specifically focused on digital assets.

· Solana rose almost 60% this past week to over $24 - its highest price point in months.

· Russia and Iran are exploring gold-backed stablecoins. The Central Bank of Iran considers a relevant partnership with the Russian Federation to facilitate international trade.

· Ethereum (ETH) hit 500,000 validators ahead of the “Shanghai upgrade,” securing its proof-of-stake migration.

· Amazon’s cloud computing partners with Avalanche.

· Binance will allow institutional investors to collateralize via Binance Custody.

· Ondo announces plan to tokenize US Treasury Bonds.

In The News

DeFi + TradFi: The Beginning of a Beautiful Friendship

This interesting op-ed elaborates on the convergence of TradFi and DeFi. Despite the dogma around decentralization and its oftentimes anti-institutional slant, institutions will ultimately financially support and benefit from DeFi and its innovations. Lots of major players, from regulators, DeFi protocols, institutional investors, and large banks recognize that blockchain technology has a major role in the future of finance. This is inevitable. The fallout from FTX highlighted skepticism around CeFi across the board and should speed up the adoption of DeFi. Do us a favor: leave centralization to TradFi, and decentralization to DeFi.

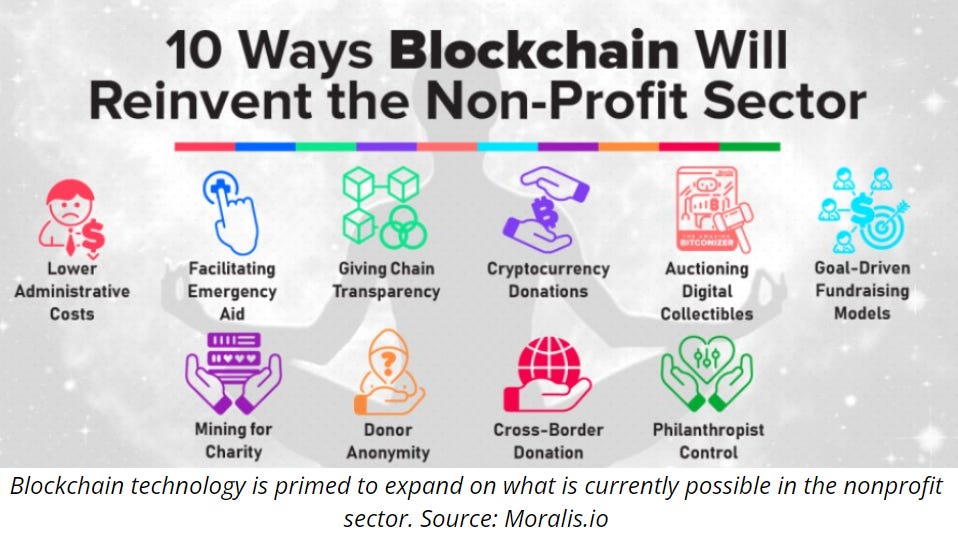

DeFi, DAOs and NFTs: Crypto is redefining how charities raise funds

Much is made of blockchain’s potential to revolutionize finance, however, not enough is made of its potential contributions to charities and non-profit organizations. One of the most encouraging developments is ReFi (regenerative finance) - the idea that DeFi can have a role in solving systemic problems that TradFi has historically overlooked and in many cases exasperated. The crypto world’s penitent for radical truth and honesty has a social good bend to it. The ability to cultivate communities and crowdfund on web3 supersedes its web2 counterparts. It’ll be exciting to see how it develops in the coming years. Definitely, something to keep an eye on!

Cross-Chain Messaging Can Blow Open Interoperability

Interoperability is one of the core utilities of DeFi (see yours truly). One of the features we are very interested in is cross-chain messaging, which has tremendous potential for growth if someone can get it right. For web3 to take over, there needs to be more of a network effect. This highlights the importance for all web3 pioneers to build with a mainstream audience in mind.

Instead of a “one protocol to rule them all” approach, it's becoming increasingly apparent the ecosystem is more likely to be made of a multitude of specialized protocols working together. So communication systems will be key. This paves the way for smart contract-enabled messenger dApps, without any need for intermediaries. The thinking now is that this feature will become important for the survival of smaller and less established protocols to carve out a niche in the ecosystem.

Hashkey Capital raises $500M to support Web3 ecosystem

Hashkey Capital, a major player in funding blockchain projects, raises $500M to support web3 initiatives. This “Fintech Investment Fund III (Fund III)” focuses on the development of infrastructure and mass adoption, especially in emerging markets. Emerging markets tend to be the hub of most web3 use cases, and VCs are taking notice. Ignore FUD and follow the money! Dollar bills don’t lie!

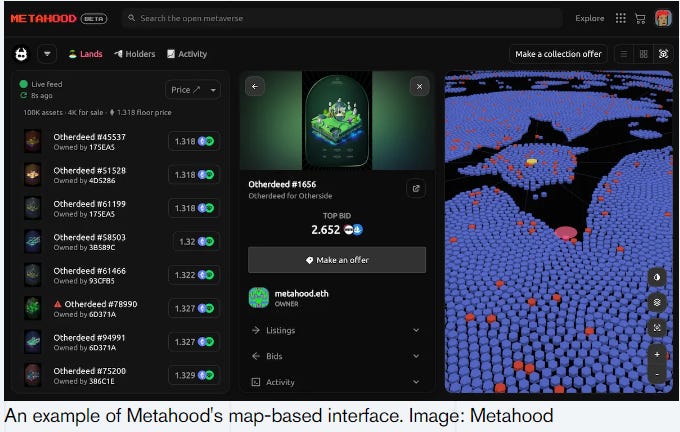

Metahood Raises $3M to Build the Zillow of the Metaverse

Metaverse startup ‘Metahood’ just raised $3M to build a platform for the buying and selling of real estate in the metaverse. Metahood seeks to add value to its users by consolidating digital property data into a map-based interface. The utility and use cases within the metaverse are still speculative but the thinking is that enough interest is there for a project to aggregate all this information into a more intuitive and consolidated way. Who’s signing up to be Zuck’s neighbor?

Crypto Wars Episode IV: Revenge of the Bull

Is it too early to declare the bear market dead? Probably but it is never too early to start investing in your future. If you start building a well-structured portfolio in a downturn you will reap the rewards when the market turns around. At Velvet.Capital, we’ll stick with you through the entirety of your investment journey.

Here is an example of one of the portfolios available on Velvet.Capital — our Blue Chip portfolio that is made up of the top 5 cryptocurrencies by total market capitalization excluding stablecoins, weighted by market cap, and rebalanced every 2 weeks. This portfolio has a 37% gain in one month.

You can get exposure to all the best projects in just a few clicks. Not bad right? Position yourself to take advantage of the next bull run market today!