Surviving the Crypto Winter & Positioning Yourself for the Future

Bear Cycles can be brutal but they’re a time to reassess, learn and improve. Position yourself for the next bull run now!

The Velvet.Capital Mission & Vision

At Velvet.Capital we’re building a cross-chain DeFi asset management protocol that helps people & institutions create tokenized index funds + other financial products with additional yields. We’re on a mission to bring financial independence- free of intermediaries and centralized parties- to the next billion crypto users. Our vision is to become the #1 multi-chain platform to manage digital assets. Check out our white paper for a deeper dive into the next big thing in DeFi.

Crypto Winter & Single Token Risk

Winter is coming. Well it came. It’s here and it’s chilly, brrrrrrr. Not even Hodor can save us now. Actually, it’s not the end of the world even though it might feel like it. The future’s still bright, the builders will keep building & more and more people will join the crypto future. But before we look forward it’s prudent to look back and learn so we can make more informed decisions in the future.

The last few months have been painful for a lot of people, as the market attempts to establish a bottom. Many coins are at multi-year lows and the massive drawdown has put a huge amount of strain on the entire ecosystem. Murmurs of defaults and liquidations loom for some of the previous ‘All-Stars’ in the space- like 3AC (which as of this week has been ordered to liquidate by a British judge; reportedly $16B to ~$20,000), Celsius, BlockFi, etc. We can’t not mention the domino that set off the whole unraveling- Terra Luna Classic.

During the month of April 2022, Terra Luna Classic was still looked at as a darling; one that you could HODL in perpetuity for the safest, most epic returns of your life. People were so hardened in this belief that they went all-in on the investment. Inevitably, like most things in life, the things that sound too good to be true usually turn out to be just that. LUNA’s price came crashing down in the month of May in historical fashion. As I write this article, it is trading at fractions of a penny, which is a very steep drop from its all-time high of 119.18 USD. You don’t have to be a math wiz to recognize that’s not the kind of return on investment that you want.

Lessons to be Learned

“How can we ensure we minimize our risk while maximizing our return? I could easily diversify by buying tons of coins, but how will I know which coins are best and how much to hold of each?”- Pondering HODL’er

Past results are not indicative of future results. Time and time again, investors attempt to predict the future and almost always fail. Crypto is no exception to this rule. Nothing goes straight to the moon- there are always peaks and valleys. Many people get caught falling in love with a project or a few projects then going all-in thinking the good times will always roll. Not a good idea. All emerging sectors go through bull and bear cycles. If you can’t be disciplined and responsible in your allocations of capital you will be burned ( this rule transcends the average person and includes massive organizations like 3AC, BlockFi, Celsius, Luna, etc). People are people- they can all make the same kind of mental mistakes.

The key is positioning yourself to reap the rewards of the bull and survive the bear with minimal damage. You do this by practicing discipline at market tops and market bottoms which is easier said than done. In tradfi markets, professional investors do this by creating balanced portfolios across sectors and asset classes. However, there aren’t many great solutions out there in crypto for this. Right now, there are a lot of DeFi posers (CeDeFi) out there that champion the principles of DeFi but are actually centralized- like Celscius.

Until now that is. You won’t have to worry about timing the market anymore. With Velvet.Capital you can enjoy the benefits of true DeFi. With Velvet.Capital regular people & institutions (DeFi-As-A-Service) can create professional-grade portfolios and indexes of crypto’s best projects in just a few simple clicks. You’ll be able to position yourself to best benefit for the next 10 years of growth across multiple chains and ecosystems without worrying about the single token risk that can cost you all your hard-earned money. It is fully transparent, trustless, and non-custodial- so no risk of having your assets seized (we’re looking at you Coinbase & Celsius).

Velvet.Capital Secret Sauce

Diversification: Modern Portfolio Theory

This is a tried-and-true risk management strategy which is usually one of the first things people learn in investing and it should be applied in the crypto world as well. A well-researched basket of high-quality projects is a great way to ensure you have access to the huge growth that’s coming in crypto over the next decade while also limiting the individual risk you’d have if you only invested in a few companies. You want to ride the wave not get pulled underneath it.

There is always a systemic risk attached to every cryptocurrency (i.e. changes in the market, government policies, etc.) but that’s true of any investment. The trick is to create a diversified enough portfolio that you avoid single token or highly correlated token risk. You can get exposure across chains, ecosystems, and layers with our DeFi asset management protocol. You’ll be positioned like a pro in a few simple clicks.

Amplify Your Returns w/ Yield Farming

We don’t just stop with modern portfolio theory, Velvet.Capital takes it a step further. We utilize highly vetted yield farming to deliver even more returns to your portfolio. Since our protocol is multichain, you will be able to look across chains and ecosystems to always make sure you’re maximizing your yield with the best projects. You can think of it as your own personal crypto portfolio on steroids.

Dark Horse Bonus: Treasury Management

In DeFi, a lot of air in the room has been sucked out by debating whether or when traditional institutional players will dive in. We think they will and we’re prepared to offer them kick-ass services when they make the leap, however, we think people are overlooking a huge potential catalyst: treasure management.

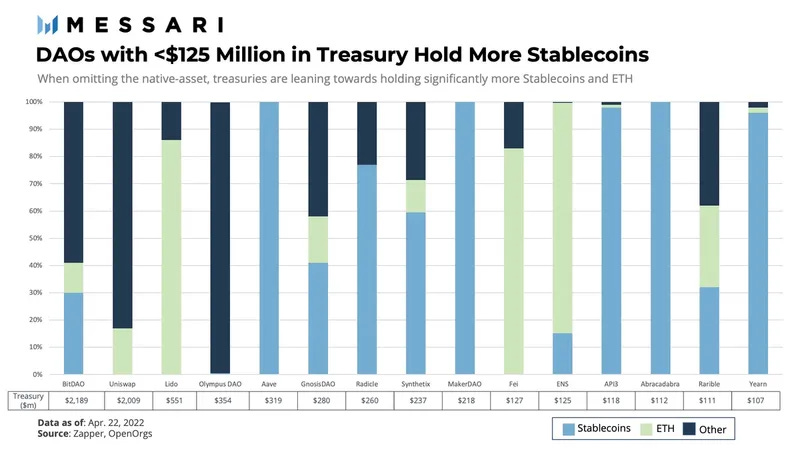

Our fellow Crypto Pioneers have been steadily building and growing their own treasuries over the past several years. Most of these projects hold mainly stablecoins and ETH. In our view, these treasuries could be better diversified through one of our complex treasury management strategies that will help to maximize their return. True DeFi has held up well during the crypto winter so that should provide some solace for skeptical treasury managers. By deploying capital into DeFi now, projects will be able to get in near the bottom, earn a quality, relatively low-risk yield and be positioned for the next bull run.

Calling All DeFi Pioneers

Our protocol goes live this September and exclusive perks and early access will go to the first DeFi Pioneers to use our platform. We don’t forget the OG’s. Early pioneers will have a chance to gain access to our exclusive governance token airdrop. So be sure to sign-up on our flagship site for exclusive access and perks to our cutting-edge DeFi asset management platform.

DeFi is going to allow people to take back control of their assets and make a more fair future where financial freedom will be more attainable for all. We’re so excited for this transformation and happy to play our part in it. We hope you join us on this journey. We would love to have you join our community.

Don’t forget to follow us on Twitter, Instagram, LinkedIn and/or join us on Discord & Telegram for more updates! We want to hear from you, don’t be shy.

Until next time,

Cheers!

New to trading? Try crypto trading bots or copy trading