The Future of DeFi, On-chain asset management, Crypto regulation, & more!

Defivas shares his thoughts on USDC's exposure to SVB, listen to us discuss the potential of passive investing in Crypto with DeFi Sparks, and qualify for our Airdrop!

Our latest podcast with DeFi Sparks:

Whitepaper: https://docs.velvet.capital/

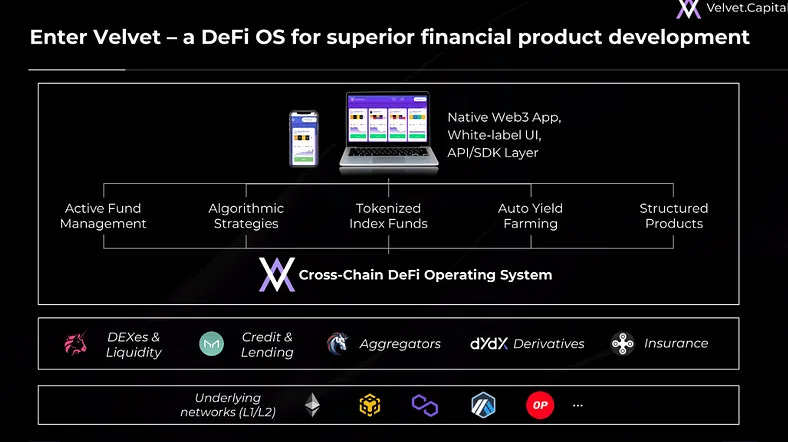

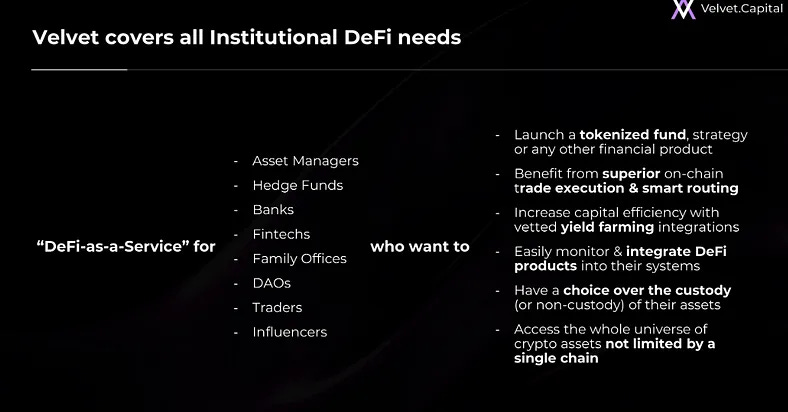

Listen in as we talk on the potential of passive investing through ETF funds on chain, the future of Velvet, potential crypto regulation, and much more! Velvet.Capital is building a DeFi asset management operating system that allows individuals and institutions to create & manage ETF-style funds and other structured products on chain.

(🚨Learn about our airdrop below.🚨)

With the success of passive investing in traditional financial markets over the last 20 years, there is no reason to believe that passive flows outstripping active flows is not going to happen in DeFi. Velvet.Capital is working to build that infrastructure for individuals and institutions alike.

Our v2 is right around the corner and our token launch is in the near future. Don’t miss your chance to be part of the next big thing in DeFi!

USDC Outlook After SVB Collapse

To read the full tweet, click on the picture above.

Yesterday, our Founder and CEO defivas posted some Napkin math on how much exposure USDC had to Silicon Valley Bank.

The TLDR is: USDC may have losses of $500M, but given the size of the Total Market Value and the Short Term Treasury Rate, they could offset these losses fairly quickly.

Qualify for our Airdrop

A Decentralized Community-Managed Ecosystem

At Velvet.Capital, we believe in DeFi done right! Financial infrastructure should be a public good — owned by its users and bring value to them! To ensure that Velvet becomes a decentralized, community-managed protocol, we are introducing VLVT, a governance token that grants voting power to token holders who stake their tokens on Velvet.

However, the utility will go far beyond governance as we strive to build a sustainable ecosystem. Velvet.Capital is earning revenue in BTC, ETH, BNB and other cryptocurrencies and will use them to buy-back VLVT from the market and distribute rewards to token holders who stake their tokens to participate in the governance. In addition to that, we’re creating a Risk Management module that will act as a back-stop in case of force majeure events (and will ultimately align incentives for the governance participants).

This aligns responsibility for due diligence and voting on integrations with accountability for staked tokens, creating a network effect that increases the benefits for users as the project grows and becomes increasingly safe. By participating in this system, you can help protect and strengthen the Velvet.Capital protocol while earning rewards for your contribution.

Token Allocation and Distribution

As a first step towards creating a decentralized community-managed ecosystem, 50,000,000 VLVT tokens will be allocated to early adopters via retroactive distribution & further staking rewards. There are three main parameters in determining the allocation:

User’s Total Value Locked (TVL) on Velvet — the more you deposit the more tokens will be allocated to you

Time using Velvet — the longer you keep your deposit the more tokens will be allocated to you

Start date — the earning rate per day will be decreasing exponentially, the earlier you join — the larger allocation you’ll earn

Aside from these parameters, to be eligible for the retroactive distribution you will have to hold Velvet products during several snapshot dates prior to the token launch. The snapshots will be publicly shared so that everyone can verify their eligibility for token distribution.

The Early Bird Gets the (Most) Tokens

The fundamental key of this model is its exponential decay function, meaning that, all else equal, the earlier you are — the more tokens you’ll receive. At the same time, this model rewards the most loyal members as it takes into account time on Velvet. Finally, this model ensures that the largest participants are rewarded more for bringing more TVL to the platform.

As a token holder, you have the opportunity to drive Velvet’s development & growth by submitting proposals that can range from new integrations and protocol upgrades to new product proposals and earning more tokens especially if you’re actively participating in the overall governance.

There will be further opportunities to earn tokens by taking on the role of Velvet Ambassador or actively contributing to the protocol development & growth. VLVT tokens will be regularly distributed to contributors (current and future) through the Velvet Ecosystem Fund which will reward development, marketing, BD, and other contributions to the Velvet protocol.

Be A Part of the Next Big Thing in DeFi

We’re looking for DeFi Pioneers to join us on our journey to reshape finance! It’s been a busy year thus far & we accomplished a lot but we have more work to do! We are backed by Binance Labs and other top Web3 and traditional funds and won hackathons & bounties at the BNB Revelation Hackathon, EthCC, EthIndia, EthNYC, Polygon Summer Hack, Ledger, Starknet Hack and others. We are super pumped to bring DeFi to the next billion users!

Imagine what we can do if you join us? Let’s build the future of finance together!

Want to know what Whales in Crypto are buying?

Refer 3 friends and get a free, exclusive report on the top Crypto holdings of top Hedge Funds and Whales!

Nice