This Week in Crypto (Dec 5th-11th)

Howdy Frens! A weekly recap of the top stories in crypto and web3!

Good Morning, Afternoon and Night Frens🖖

Never a dull week in the Cryptosphere. Rain or shine, we march on! Let’s not waste any time and dive right in! As always we want to hear from you — share your thoughts below or track us down on socials and give the Velvet.Capital Fam a shoutout!

Weekly Round-Up

ECB Seeks Urgent Regulation After Multiple Crypto Bubbles Burst

The European Central Bank (ECB) is calling for stronger regulation of crypto assets. “This is not just a bubble that is bursting. It is like froth: multiple bubbles are bursting one after another,” Fabio Panetta, board member of the ECB said in a speech in London. “Investors’ fear of missing out seems to have morphed into a fear of not getting out.” Panetta urges governments to be more involved in the regulating of crypto assets, under the guise of regulating criminal activity, protecting investors, and connecting DeFi to traditional financial markets.

The news signals that most regulators accept that crypto is here to stay, and can’t be regulated out of existence (we told ya so!). Not to fear — this is natural for all emerging technologies and industries. The market cycles can be particularly rough the earlier you are but it just sets the stage for further growth and innovation by removing waste, fraud, and dead weight. Regulation is necessary for the advancement of the space as a whole.

DeFi and Web3 Startups Attract $3B in Funding in Third Quarter

Always follow the money- folks! Despite a sagging market, venture capitalists have poured over $3B into funding DeFi/web3 this past quarter. Although it’s a 24% decrease from Q2, it’s more than this time last year. The chart below demonstrates the correlation between the price of BTC and overall market sentiment.

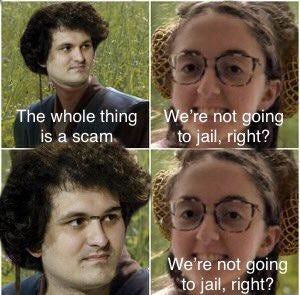

What Happened at FTX? (Spoiler Alert: Nothing Good)

Maybe the ‘Black Swan’ event of this Crypto Winter — ‘The Defiant’ lays out an informative explainer about the rise, and ultimate fall of FTX, and its eccentric supreme leader: SBF. Previously the darling centralized exchange, FTX at one time touted a valuation of $32B. On November 11th, they filed for Bankruptcy protection in the US (as a Bahamas entity). This culminated when the financial health of FTX, and its affiliated Alameda Research, were brought into question.

A series of questionable (if not outright fraudulent) financial decisions, highlighted by a portfolio leveraging FTT (it’s native currency), caused the valuation to implode when flashed under a microscope. This situation is far from over and will only continue to unfold (maybe unravel more aptly put) in front of our eyes in real time. Hollywood hasn’t waited to pounce either, with an Amazon Prime Limited Series already greenlit covering the saga. Mark your content calendars.

Niagara Falls, N.Y., is shutting down three cryptocurrency mining operations

The city of Niagara Falls is suing to shut down three crypto mining operations. “Several companies, which have never complied, are operating in violation of long-standing zoning and building codes and creating potentially dangerous public nuisances,” says Mayor Robert Restaino. This comes after residents complain of noise and disruption at a recent public hearing on the matter. The city’s access to hydroelectric makes it a great candidate for mining, but not at the expense of the quality of life for locals.

Opera Crypto Browser to enable instant NFT minting through launchpad

Opera announces they plan to partner with Alteon Launchpad to enable instant NFT minting through their browser. Users would be able to access an application that lets them drag and drop media files directly into their browser, which writes a smart contract and uploads the file on-chain, seamlessly minting NFTs. It’s always exciting to see large companies bringing their audience into web3 as conveniently and turnkey as possible.

We’re making DeFi simpler, sleeker, and safer than ever before.

Check out what’s cooking in the Velvet.Capital Labs: https://velvet.capital/

Velvet.Capital is a cross-chain DeFi asset management protocol that helps people & institutions (DeFi-as-a-service) create tokenized index funds, portfolios, and other financial products with additional yields. Our customizable portfolios operate across chains & ecosystems to offer the broadest exposure on the market. We utilize modern portfolio theory & highly vetted yield farming to amplify your returns.

Visit, https://velvet.capital/, for more information or email [email protected].