U.S. enters the Goldilocks Zone; CZ declares DeFi a Favorite of Next Bull Market; & More!

U.S. job market's potential slowdown and its implications for crypto markets. Binance CEO, CZ, predicts DeFi's dominance in the nebull market, while global crypto regulation efforts continue to evolve

Market Landscape

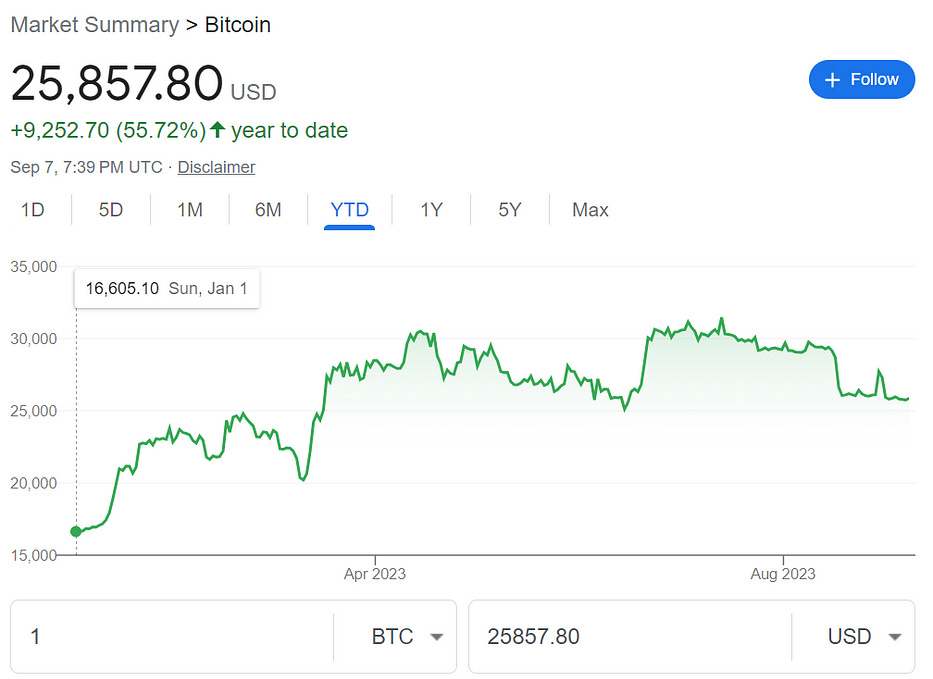

Crypto markets have continued to remain relatively fixed in the $25,000 to $30,000 range since late March. That’s not to say we haven’t had our fair share of swift moves in both directions but we seem to be locked into a range until there is more regulatory and economic clarity.

Speaking of - more broadly, this past week, U.S. job market data showed early signs of a potential weakening in the labor market. While a single month doesn’t define a trend, recent data consistently suggests a return to normalcy after a period of substantial gains. Two major implications arise from this: The Federal Reserve might see this as a reason to maintain current interest rates, and there might be a limit to the near-term rise in Treasury yields due to the potential implications of milder economic growth and reduced inflationary pressure.

A gradual slowdown in the labor market, without a severe or extended downturn, could be beneficial for crypto and financial markets, especially if it indicates the end of the Fed’s rate hikes. Although markets might experience some short-term instability, especially in historically volatile months like September, the combination of a slowing labor market, milder services inflation, and a halted Fed rate-hike cycle is anticipated to benefit both equity and bond markets in the long run. The desired outcome is a balanced labor market that’s neither too cold nor too hot — hence the goldilocks moniker.

Quick Hitting Alpha

· India’s Finance Minister Nirmala Sitharaman highlights the importance of global cooperation in regulating cryptocurrencies ahead of the G20 summit, considering ongoing discussions and a synthesis paper from the Financial Stability Board and the International Monetary Fund.

· An Appeals Court’s ruling against the SEC in the Grayscale case signals a potential check on crypto regulatory overreach, briefly lifting the crypto market and boosting Coinbase stock by 14%.

· Swift showcases its ability to enable cross-blockchain transfers of tokenized assets with Chainlink’s Cross Chain Interoperability Protocol, advancing its mission to facilitate connectivity between CBDCs and digital assets, despite concerns about Chainlink’s centralization.

· Traders face exorbitant fees of up to 2,000% annualized when buying CYBER tokens on margin, despite the crypto’s rapid price surge and increased trading volume to $225 million in 24 hours, but sustainability concerns loom due to high funding rates and parallels with past projects.

· Singapore’s new president, Tharman Shanmugaratnam, who secured 70.4% of the vote, has previously referred to crypto as “purely speculative” and “slightly crazy,” hinting at a potentially cautious stance on the asset class as he assumes a ceremonial role with potential influence on financial policies, including those concerning cryptocurrencies and central bank digital currencies.

· Australia’s Senate Economics Legislation Committee rejects opposition senator Andrew Bragg’s “The Digital Assets (Market Regulation) Bill 2023” due to insufficient detail and international alignment concerns, drawing criticism for impeding crypto asset regulation in the country.

· Ethereum founder Vitalik Buterin sold his 500 MKR tokens for $580,000 in 353 ETH following a proposal by MakerDAO’s co-founder Rune Christensen to migrate to a Solana fork, leading to a 5.6% dip in the MKR governance token and prompting Buterin to urge competitor Reflexer to adopt a more “activist” governance approach amid MakerDAO’s planned network exit.

· Binance CEO Changpeng Zhao anticipates DeFi potentially surpassing CeFi in trading volumes during the next bull run, pointing to DeFi currently representing 5–10% of CeFi volumes and a 444% surge in decentralized exchange trading volumes after SEC actions against major centralized exchanges.

· The Bank of China and Meituan, an e-commerce giant, are enhancing their digital yuan collaboration, moving beyond retail commerce to explore corporate services using CBDCs and cross-border applications, including hardware wallets for greater financial inclusion.

· The SEC’s inaugural NFT-related enforcement action targeted Impact Theory’s “Founder Keys,” imposing a $6 million fine and mandating the destruction of all NFTs due to an unlawful, unregistered offering marketed as an investment.

In the News

Cryptonews Podcast with Navin Vethanayagam, Chief Brain at IQ.wiki | Ep. 261

In an exclusive interview with cryptonews.com, Navin Vethanayagam, Chief Brain of IQ.wiki, discusses the potential of AI and blockchain convergence. Vethanayagam, a seasoned professional with a rich background in community management and international business, highlights the disruptive capabilities of collaborative AI-blockchain applications. He also underscores blockchain’s pivotal role in restoring trust by verifying content authenticity. This dynamic conversation explores the future of these technologies and their transformative impact. For the full interview, visit cryptonews.com and delve into the insights of this visionary thinker at the forefront of AI x blockchain innovation.

The Relationship Between Bitcoin and Interest Rates Is Breaking Down

In an era of economic uncertainty, Bitcoin’s meteoric rise and Nvidia’s surging stock prices defy initial recession forecasts in the United States. Arthur Hayes, the founder of BitMEX and Chief Investment Officer at Maelstrom, explains that this unexpected turn of events stems from the Federal Reserve’s interest rate hikes, which have unintended consequences. As asset prices rise, so do capital gains taxes and government revenue, but when the Fed raises interest rates, these prices may plateau, reducing tax income. This prompts the U.S. Treasury to issue more bonds, leading to interest payments that boost spending and nominal GDP growth, creating an intriguing paradox. Despite this economic turbulence, Hayes remains bullish on the cryptocurrency industry, emphasizing its resilience. Additionally, he highlights the growing independence of AI companies from traditional banks, suggesting that investing in these entities may be a wise move amidst the uncertain economic climate.

185 — The Superchain Explained with Jesse Pollock & Ben Jones

In this episode, the hosts welcomed Ben Jones, Co-Founder of Optimism and Creator of Base, along with Jesse Pollock. They discussed the remarkable growth of Base which has nearly reached 1 million users in just two weeks and boasts a higher transaction throughput than Ethereum’s mainnet. They also explored the significance of Base chain being built on Optimism’s technology stack and how it represents just one of many chains that will emerge in the coming years. The conversation delved into the concept of the Superchain, a pivotal element in the quest to onboard 1 billion people onto the blockchain.

Swift Could Support Interconnected CBDCs Via Chainlink

In a recent report, Swift, the global interbank messaging service, showcased how over a dozen major financial institutions, including ANZ, BNP Paribas, and BNY Mellon, utilized Chainlink’s Cross Chain Interoperability Protocol (CCIP) to securely transfer tokenized assets across various blockchains in the Web3 ecosystem. This collaboration marks a significant step in enabling seamless integration between traditional banking systems and both private and public blockchains, easing the complexities of tokenized asset development. Notably, Swift’s initiative also aligns with its broader strategy to facilitate interconnectivity between CBDCs and other digital assets. However, concerns have emerged about Chainlink’s decentralization, as it remains a topic of debate within the industry, with some experts pointing to potential security risks associated with its centralized aspects.

How Does Velvet.Capital Help You Achieve Crypto Success?

Build your custom portfolio today: https://velvet.capital/

Crypto can be hard. DeFi can be even harder! But it doesn’t have to be! At Velvet.Capital, we believe in DeFi done right. We’re passionate about the transformational nature of DeFi and want to help onboard the next billion users into crypto.

We help people create diversified crypto products with additional yield — all without giving up custody of their assets! No matter your level of expertise — we got you covered!

Our v2 is Right Around the Corner 👀

Join the Velvet Community today. Follow us on Twitter, LinkedIn and join us on Discord & Telegram for more updates! We want to hear from you, don’t be shy.