U.S. Productivity Surges, Yuga Labs Dives Deep into Metaverse, and much more!

Market Landscape

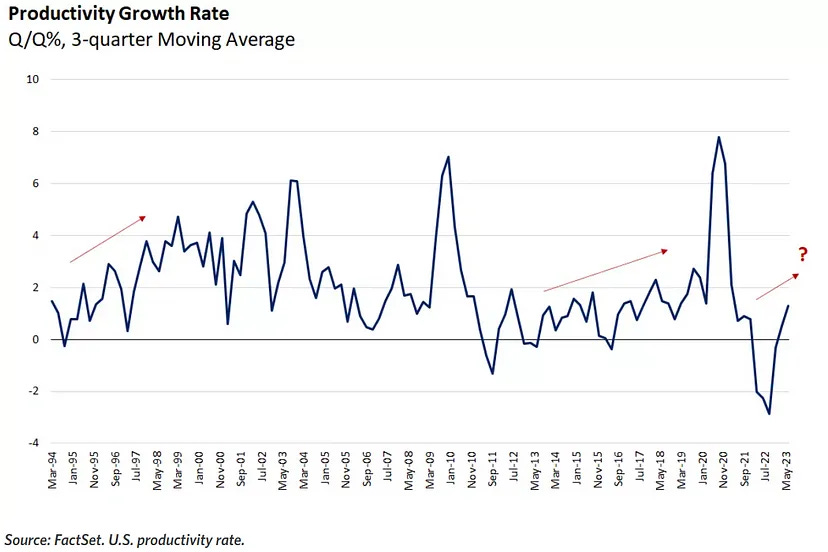

Across traditional financial markets and the crypto world, all eyes are on the labor market, inflation, and the Fed. Investors are eagerly watching for signs of the labor market’s resurgence and a drop in inflation, although it’s crucial to remember that these trends are intertwined rather than mutually exclusive. Recent economic data has offered a mixed bag of signals, with softer employment figures followed by a more optimistic outlook, featuring robust productivity and ISM services figures that hint at ongoing growth.

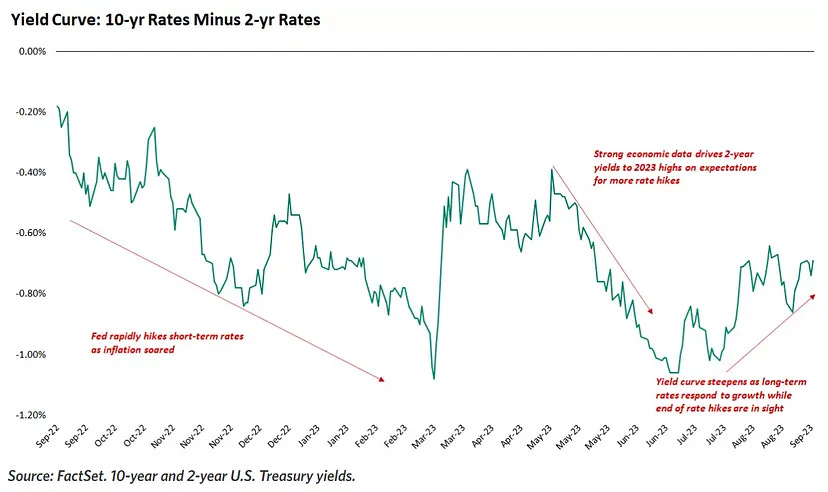

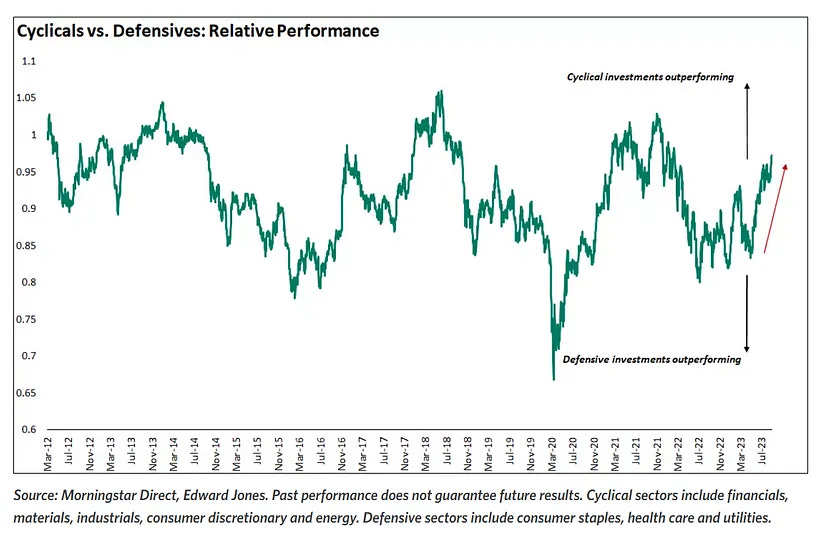

Amidst this backdrop, we’ve witnessed a steepening of the yield curve and the outperformance of cyclical investments in recent months, bolstering the argument for a broader bull market. However, we’re not out of the woods just yet. The Federal Reserve’s future policy decisions will be heavily influenced by the intersection of employment and inflation trends, ultimately shaping short-term market movements.

August core inflation, excluding food and energy, rose 0.3% — slightly hotter than expected but within expectations. Still, the resurgence of oil prices, a potential commercial real estate bubble, and persistent housing costs could add twists to the story — potentially becoming catalysts for market fluctuations.

It’s important to remember that macro factors have outsized impacts on risk assets — like crypto. It will be important to continue to follow these trends into the new year as we approach The Halvening!

Quick Hitting Alpha

· Standard Chartered’s Zodia Custody has launched in Singapore as the first bank-owned and partnered entity to offer digital asset custody services, capitalizing on the city-state’s growing role as a fintech hub and crypto-friendly regulatory landscape.

· DFZ Labs, creators of the NFT brand Deadfellaz, is teaming up with MetaMask and its 21+ million monthly active users to debut ‘Culture On-Chain,’ a series highlighting Web3 innovations and creators, as Korea becomes a global Web3 hub during Korea Blockchain Week.

· Ark Invest and 21Shares are seeking approval for the first U.S. spot Ether ETF, offering an economical avenue for Ether investment via standard brokerage accounts. Coinbase Custody will safeguard the ETH assets, with valuation tied to the CME CF Ether-Dollar Reference Rate.

· Despite crypto market challenges and regulatory concerns, almost half of the 60 surveyed buy-side professionals from U.S. and European asset managers and hedge funds are actively handling digital assets. Among them, 25% already employ specific strategies, and an additional 13% intend to do so within the next two years, indicating optimism about U.S. growth and regulatory potential.

· The U.S. Commodity Futures Trading Commission (CFTC) has charged DeFi protocols Opyn, ZeroEx, and Deridex with offering illegal derivatives trading, issuing cease-and-desist orders, and imposing financial penalties as part of a settlement, despite some dissent within the commission about the enforcement approach.

· Stake Crypto Casino, a major Australian-Curaçaoan crypto gambling platform with $2.6B in 2022 revenue and high-profile sponsorships, has resumed operations after a $41 million exploit targeting its ETH and BSC hot wallets, assuring that user funds are unaffected and hinting at potential links to North Korean hackers.

· The Russian Central Bank is considering the option of “marking” or “color-coding” digital ruble tokens to track transactions and usage, although Deputy Governor Alexei Zabotkin clarified that such plans are currently theoretical and would be discussed at a later stage of the digital ruble pilot program.

· Yuga Labs, known for the Bored Ape Yacht Club NFT collection, is building The Otherside, an expansive metaverse project. It aims to unite multiple NFT communities and digital economies, backed by a $450 million investment round, valued at $4 billion. The project includes a marketplace, unique land plot NFTs called “Otherdeeds,” and the inaugural game, Legends of the Mara, with an open beta scheduled for September 2023. These elements are fueled by their native utility and governance token, ApeCoin.

· A hacker took control of Ethereum founder Vitalik Buterin’s Twitter, posting a phishing scam that tricked users into losing valuable NFTs and tokens worth over $700,000, including a historically significant Larva Labs Crypto Punk NFT.

· Christie’s is auctioning five 1987 digital artworks by Keith Haring as Ethereum NFTs in an online event called “Keith Haring: Pixel Pioneer” from September 12–20. These pieces, estimated to sell for $220,000 to $500,000 each, represent a connection between the traditional art world and the emerging Web3 space.

In The News

Predicting Bull Runs, Filing for ETFs, Collecting Txn Info and 20 Crypto Jokes

Cryptonews.com put together an explainer covering all of the current events of the past week. It’s so many, we can’t even put them all here!

The Blockchain Trilemma — ETH Vs SOL Vs ATOM with Mike Ippolito

Bankless sat down with Mike Ippolito, co-founder of Blockworks, to delve into the intriguing world of the Blockchain Trilemma and its implications for leading blockchain networks like Ethereum, Solana, and Cosmos. This engaging interview explored how these platforms are addressing the challenge of balancing security, decentralization, and scalability. While Ethereum tackles this trilemma with its upcoming Ethereum 2.0 upgrade, Solana offers exceptional speed at the cost of some decentralization, and Cosmos fosters interoperability among diverse chains. As they wrapped up, it became clear that the blockchain space is on the brink of a multi-chain future, where each network specializes, promising an exciting era of decentralized technology.

US Interest Rates High Enough to Tame Inflation, Avoid Recession: Chicago Fed

Recent research from economists at the Federal Reserve Bank of Chicago suggests that the US central bank’s recent interest rate hikes may have successfully brought inflation under control without causing a recession. This development could create an ideal environment for risk assets, including cryptocurrencies. The economists’ model indicates that the substantial rate increases implemented since March 2022 have already had a significant impact on output and inflation, making further hikes potentially unnecessary. The research predicts that the consumer price index could drop below 2.3% by mid-2024, aligning with the Fed’s 2% inflation target. This scenario, referred to as a “goldilocks” moment, would be conducive to risk-taking in global financial markets. However, the Fed remains cautious about signaling an end to the rate-hike cycle, and some investment banks anticipate rates remaining higher for an extended period. The study underscores the role of expectations in influencing the impact of rate increases on inflation and the economy, suggesting that the effects may still be potent enough to bring inflation near the target quickly.

Tether’s CTO Explains Why USDT is Still Not Audited

In their latest podcast, The Defiant interviewed Tether’s CTO, Paolo Ardoino, and the inner workings of their prominent stablecoin. The discussion covered critical aspects such as Tether’s banking partnerships, reserve composition, recent attestation, and the ongoing absence of a formal audit. Ardoino addressed concerns about the audit issue, acknowledging the challenges faced by auditing firms in the crypto industry due to regulatory ambiguity. Despite these hurdles, Tether remains committed to transparency and is actively collaborating with auditing firms to ensure comprehensive audits in the future. This conversation provided valuable insights into Tether’s operations and its efforts to maintain stability and trust in the crypto markets.

Bored Ape Creator Giving Away Bitcoin in Ordinals Puzzle Game

Yuga Labs, the creators of the Bored Ape Yacht Club and the TwelveFold generative art collection, have launched an intriguing initiative combining art, puzzles, and Bitcoin rewards. The TwelveFold collection, built on the Ordinals protocol, serves as the foundation. Yuga Labs has introduced a series of cipher puzzles inspired by TwelveFold, offering Bitcoin prizes to participants. These puzzles, centered on the concepts of time, mathematics, and variability, are designed to challenge and engage participants. Over 12 weeks, Yuga Labs will release a “Moon Puzzle” weekly, rewarding the first correct solver with 0.12 Bitcoin (approximately $3,090). In the 13th week, a “Sun Puzzle” replaces the Moon, with the victor receiving a coveted TwelveFold Ordinal, which currently holds significant value on secondary markets.

How Does Velvet Capital Help You Achieve Crypto Success?

Crypto can be hard. DeFi can be even harder! But it doesn’t have to be!

At Velvet Capital, we are building the world’s first institutional-grade, omnichain DeFi asset management operating system! Anyone will be able to seamlessly launch and manage on-chain funds — in just a few clicks. Crypto portfolio management like never before!

We help people create diversified crypto products with additional yield — all without giving up custody of their assets! No matter your level of expertise — we got you covered!

Join Velvet DAO Today!

Join the Velvet Family! Top web3 builders, giga-brains, fund managers, & investors await you in Velvet DAO!

Follow us on Twitter, LinkedIn and join us on Discord & Telegram for more updates! We want to hear from you, don’t be shy.