Velvet Capital Integrates with Beefy Pools on Base: Unlocking New Yield Opportunities

Trade any Beefy Base Liquidity Pool on Base today through the Velvet Capital Intent OS for DeFi

At Velvet Capital, we are constantly evolving to bring our users the best in decentralized finance (DeFi). Today, we're excited to announce our latest integration with Beefy Base Pools, marking a new chapter in yield optimization for our community.

How Beefy Pools Generate Yield

Beefy Pools are designed to maximize returns through a process known as yield farming. Users provide liquidity by depositing their tokens into various pools, which are then strategically allocated across multiple DeFi protocols to earn rewards. Beefy’s automated strategies reinvest these earnings back into the pools, compounding interest over time. This automated compounding boosts the potential yield, allowing users to benefit from optimal returns without having to manage the process manually.

Seamless Yield Optimization on Base

By integrating Beefy Base Pools, Velvet Capital users can now effortlessly tap into optimized yield strategies across multiple DeFi platforms. This collaboration allows users to maximize returns on their assets through automated strategies, compounded rewards, and strategic liquidity management, all accessible through Velvet Capital's intuitive interface.

Enhanced Liquidity Options: Our partnership with Beefy enables users to access diverse liquidity pools, enhancing the depth and breadth of yield farming opportunities.

Automated Compounding: With Beefy’s automated strategies, users can benefit from continuous reinvestment of their rewards, allowing for maximized compounding without manual intervention.

Simple Way to Deposit into Beefy Pools on Velvet Capital

To kick off the integration, the Beefy Team decided to create three different diversified pools on the Velvet Base App. By participating in these vaults you will earn Velvet Points daily, and five users who hold at least one of these three Beefy Vaults on Velvet on 9/7 will receive 50 points as a bonus giveaway!

This vault holds 5 Beefy Base Liquidity Pools on Aerodrome of some of the top assets such as ETH, USDC, AERO, and BTC.

Pool and APY:

BTC-USDbC (11.4%)

tBTC-ETH (1.47%)

ETH-USDC (29.5%)

USDC-AERO (112%)

ETH-wstETH (4.8%)

Fees = 0%

This vault holds 4 Beefy Base Liquidity Pools on Aerodrome of stablecoins and aims to provide market neutral returns with juicy APYs.

Pool and APY:

USDC-MAI (24.2%)

USDC+-USD+ (24%)

USDC-eUSD (12.2%)

DOLA-USDC (18.3%)

Fees = 0%

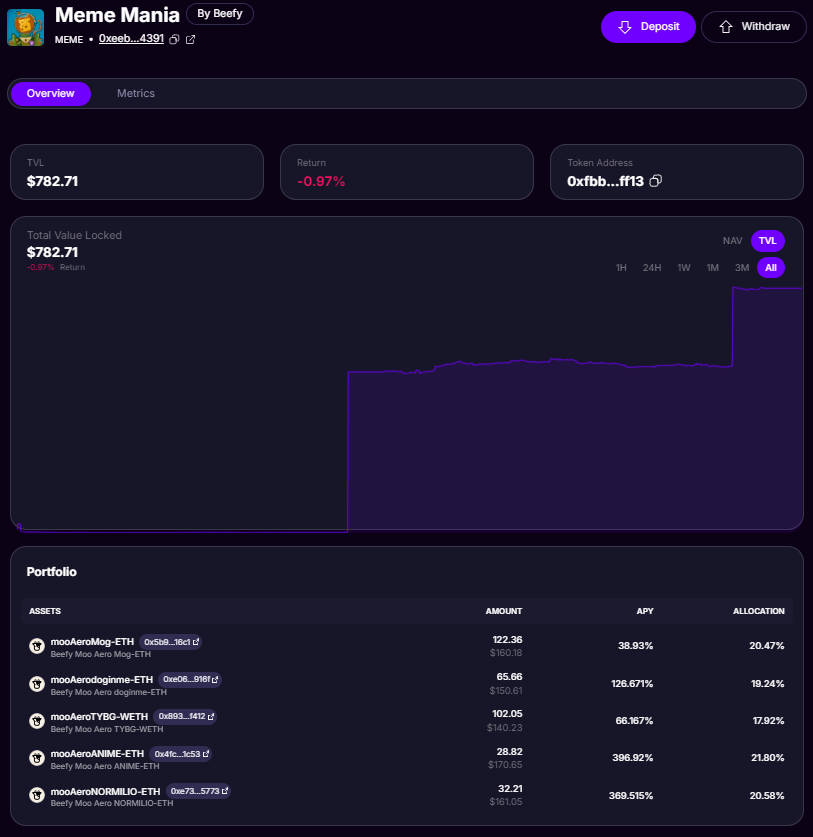

This vault holds 5 Beefy Base Liquidity Pools on Aerodrome of some of the most liquid memecoin pairs and earns some aggressive APY due to the added risk.

Pool and APY:

MOG-ETH (38.9%)

DOGINME-ETH (126%)

TYBG-wETH (66.1%)

ANIME-ETH (396%)

NORMILIO-ETH (4.8%)

Fees = 0%

How to Get Started

Integrating with Beefy Base Pools is straightforward. Either create a public or private vault on the app. Once you’ve made the vault, you can swap into any Beefy Pool by scrolling down and selecting a pool. We currently have over 100 Beefy Liquidity Pools on the Base App for blue chips, meme coins, stablecoins, and altcoins.

All you have to do to select a Beefy pool is click the Beefy Logo in the swap section and find the pool you want to add to your vault!