Velvet Capital Integrates with Morpho: Elevating Yield Optimization in DeFi

Morpho is a leading DeFi lending protocol on Base. Through the integration, Velvet Capital users can add Morpho Vaults to their portfolio. Read until the end to see your chance at extra $pVLV.

At Velvet Capital, we continuously evolve to bring our users the best DeFi solutions. Today, we are excited to announce a powerful new integration with Morpho, a leading DeFi lending protocol. This collaboration aims to enhance yield optimization across both platforms, offering Velvet Capital users access to Morpho Vaults, which is known for its efficient capital allocation and superior returns.

Overview of Morpho

Morpho is an open, efficient, and resilient platform that enables anyone to earn yield and borrow any asset. Additionally, developers or businesses can use its flexible, immutable infrastructure to create markets, curate vaults, and build a range of applications.

Since its launch, Morpho has grown to more than $3 billion in assets supplied, making it one of the most used DeFi protocols in the world. Designed to serve end-users, developers, and businesses alike, Morpho aims to establish itself beyond just crypto and serve as a cornerstone of a new internet-native financial system.

How Morpho Pools Generate Yield

Morpho Vaults operate through an innovative system that combines the benefits of peer-to-peer lending with liquidity pooling. Here’s how it works:

Deposit in a Morpho Vault: Earn yield by depositing an asset into a vault curated by third-party risk experts. Each vault has a unique risk profile and strategy determined by the curator. Creating Morpho Vaults is permissionless, so users should assess a vault’s curator and risk exposure before depositing.

Assets are supplied on Morpho: A Morpho Vault can only allocate deposits on Morpho Markets whitelisted by the curator. Depositors are exposed to risks related to the parameters of each market, including the collateral asset, liquidation LTV, and oracles.

Earn yield from borrowers: Vaults generate a yield from over-collateralized lending. Borrowers deposit collateral and borrow liquidity from the underlying markets, paying interest to the vault.

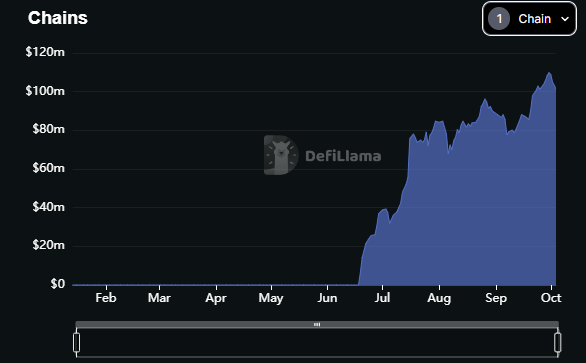

Growth of Morpho

Since its inception, Morpho has seen tremendous growth, particularly with its expansion to Base. Mopho launched on Base in June of 2024 and has seen its TVL cross $100 million already becoming the 5th largest DeFi protocol on Base. The rapid growth highlights its appeal and adoption within the Base DeFi community.

Morpho on Velvet

By integrating Morpho Vaults on Base, Velvet Capital users can now effortlessly tap into all the yield bearing assets they have to offer. This collaboration allows users to maximize returns on their assets through automated strategies, compounded rewards, and strategic liquidity management, all accessible through Velvet Capital's intuitive interface.

To celebrate the launch of Morpho on Velvet Capital, we have created two portfolios for users to deposit into and receive boosted rewards!

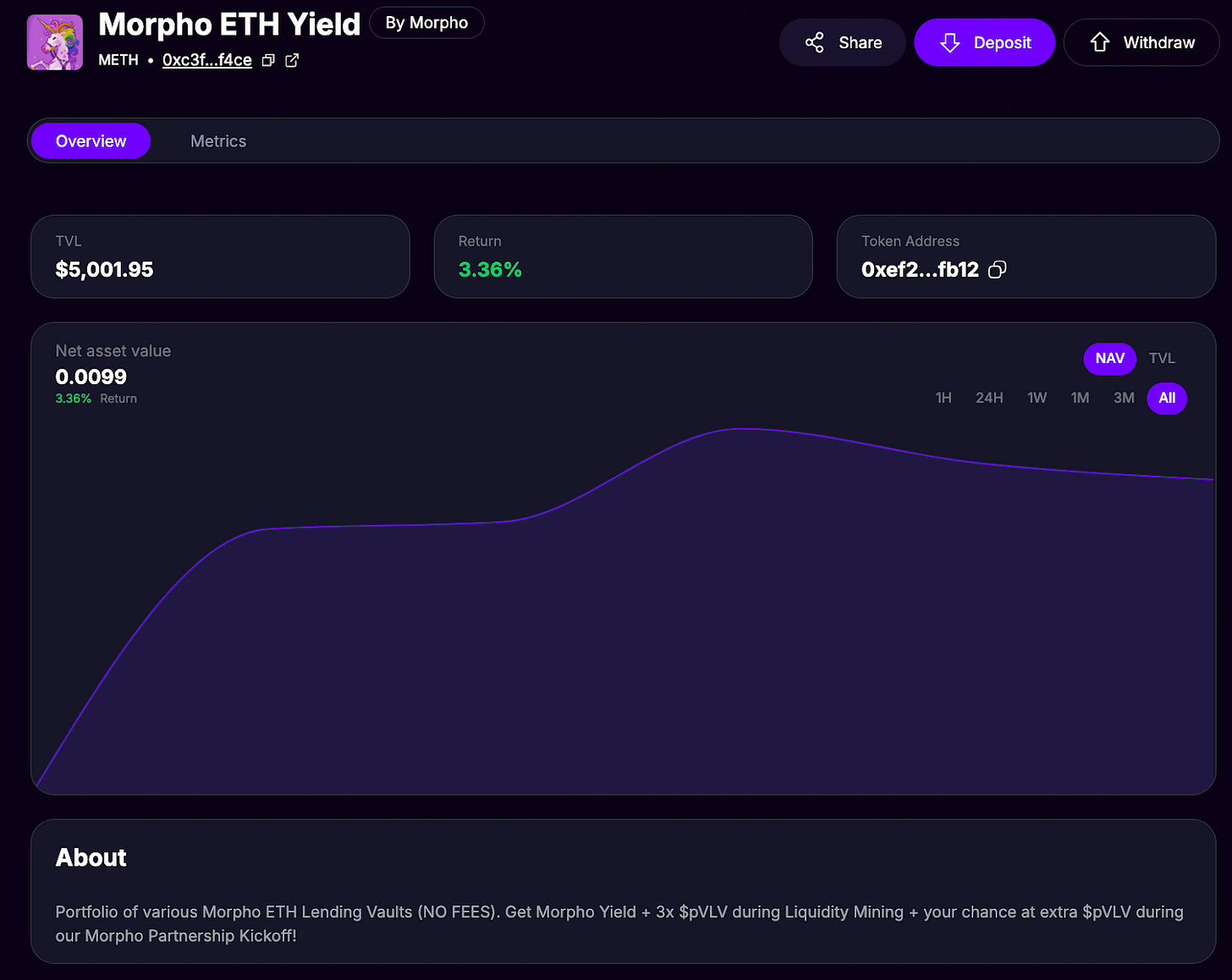

Morpho ETH Yield

Holdings in Morpho ETH Yield:

20% Morpho Gauntlet WETH Core Vault: 4.8% APY: 38.1% wsuperOETHb, 29.65% wstETH, 26.29% ezETH, 3.68% weETH, 2.19% wstETH

20% Morpho Re7 WETH Vault: 8.15% APY: 85% wsuperOETHb, 12.8% weETH, 2.08% bsdETH

20% Morpho Moonwell Flagship ETH Vault: 8.07% APY: 77.55% wstETH, 13.95% USDC, 8.12% cbETH, .28% rETH

20% Morpho Steakhouse ETH Vault: 1.95% APY: 73.96% cbETH, 24.86 wstETH, 1.14% cbBTC

20% Morpho Pyth ETH Vault: 9.1% APY: 84.64% ezETH, 14.21% weETH, 1.12% wstETH

Check out the “Morpho ETH Yield” Portfolio: https://dapp.velvet.capital/VaultDetails/0xef2a90ced4615dd025dd86eeccef26184522fb12

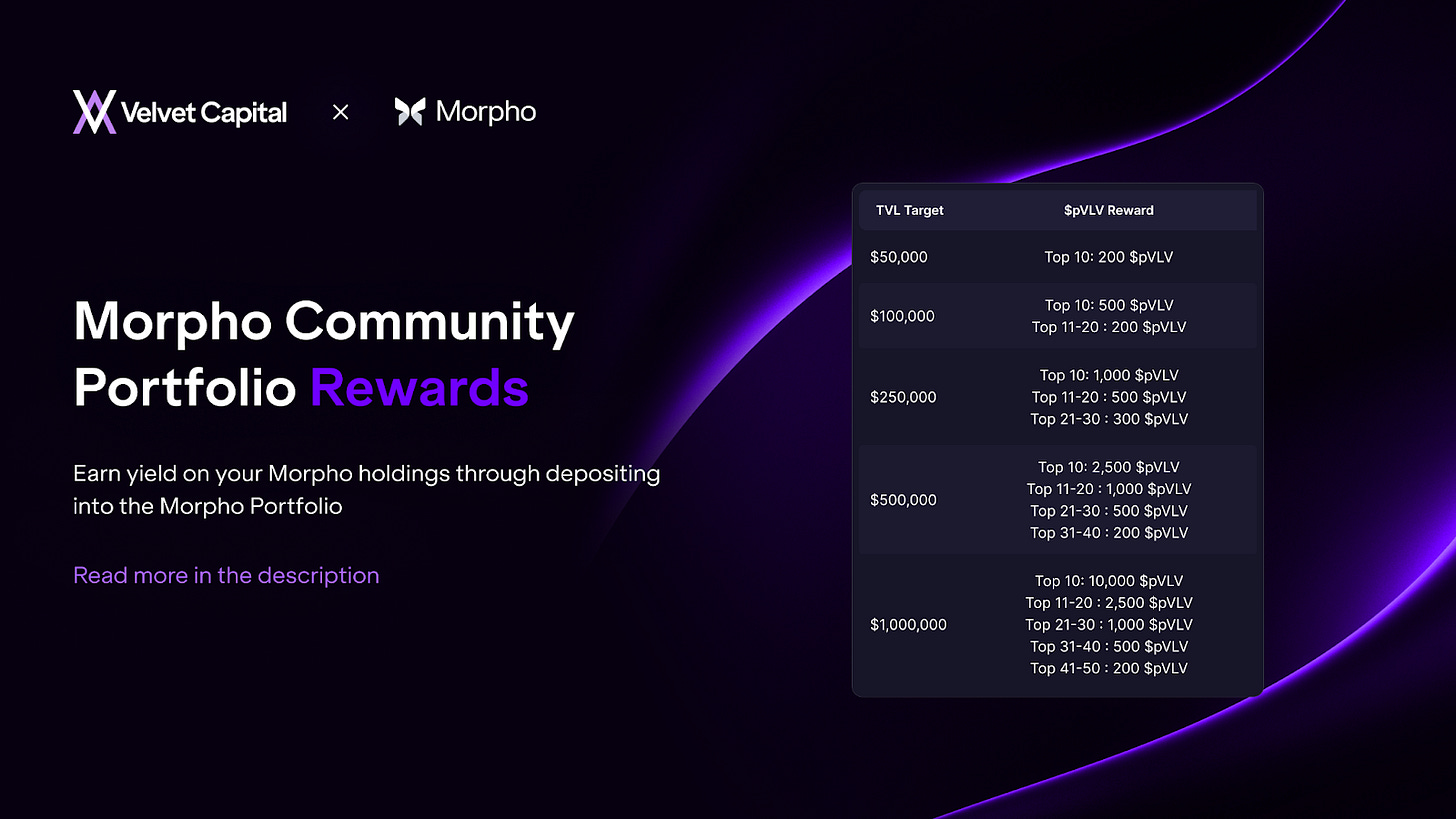

Rewards

To celebrate the Kickoff of Morpho Assets on Velvet Capital, we will be giving rewards to depositors based on the following TVL Tiers that the “Morpho ETH Yield” portfolio hits.

The integration between Velvet Capital and Morpho will bring Velvet users unprecedented access to Morpho's optimized lending markets, enhancing yield in their portfolios. Whether through Morpho’s direct lending markets or its efficient Morpho Vaults, users will now have more ways to maximize returns and participate in the rapidly growing DeFi ecosystem.

Stay tuned for more updates as we continue to build the future of decentralized finance—securely and efficiently—with our latest integration with Morpho.