Velvet Founder Gives a Talk at EthCC on AI Agents in DeFi

Inside Velvet’s quest to turn DeFi’s chaos into alpha with multi-agent AI and intent-driven execution

From DeFi Chaos to Intelligent Order

This past week, DeFi Vas gave a speech on the ETHCC Main Stage in Cannes on DeFAI Agents, and what we are building with Velvet Capital and Velvet Unicorn AI!

DeFi has gone from a handful of protocols to thousands, across hundreds of chains, with tens of thousands of tokens launching every day

Our thesis: In a world where alpha never sleeps, even the most dedicated traders can’t monitor every chain, asset, and protocol. Leading to what will be AI agents stepping in to do the work that once required an army of analysts—24/7.

WATCH THE FULL VIDEO

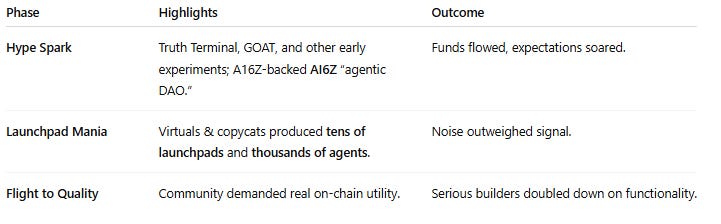

The Boom-and-Bust of the “Agentic” Meta

DeFi Vas started with the rise of DeFi-AI (DFAI) agents:

The takeaway? Novelty alone doesn’t last—utility wins.

Plotting the Agent Landscape

DeFi Vas mapped agents on two axes:

Functionality (research ↔ execution)

Autonomy (human-in-the-loop ↔ fully automated)

Most projects today live in the “Co-Pilot” quadrant—capable of on-chain actions but still requiring explicit prompts.

The North Star is the high-function, high-autonomy corner where agents manage entire portfolios end-to-end.

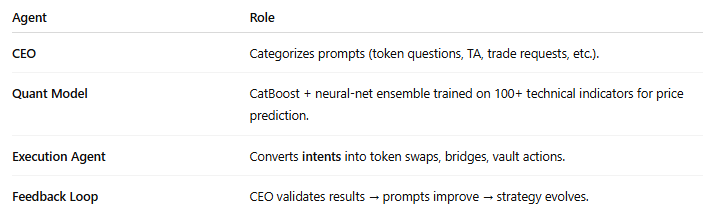

Inside Velvet’s Multi-Agent Stack

Velvet Capital has been iterating fast:

v1 Swarm – Manager → Executor, Analyst, Newsmaker

v2 “CEO-Led Org” – A CEO agent triages tasks to specialized teammates:

“We married GPT-style reasoning with hedge-fund-grade quant models—LLMs for insight, statistics for precision.”

Intent-Based Architecture: Fewer Hallucinations, Better Trades

LLMs excel at understanding what a user wants, but they’re prone to “hallucinating” how to do it on-chain. Velvet solves this with an Intent Orchestration Layer:

LLM extracts user intent.

Intent Solver finds optimal path (routing, gas, slippage).

Execution Engine submits the transaction.

The result: reliable, auditable trades without forcing users to craft raw calldata.

ACP — The “Nation-State” of Agents

Looking beyond single-player mode, Velvet Unicorn is an alpha agent in the Agent Commerce Protocol (ACP) with the Virtuals ecosystem:

Agents can buy and sell specialized services (research, risk, execution).

Complex workflows (e.g., hedge-fund strategy) compose multiple agents seamlessly.

Think cross-chain DeFi meets micro-service marketplaces—all automated.

Early Outcomes

Velvet’s quant-assisted strategy outperformed a simple HODL benchmark in back-tests.

The multi-agent design slashes context overload and cuts hallucinations dramatically.

Power users are already automating stop-losses, bridged arbitrage, and curated memecoin sniping—straight from a chat-style interface.

Key Takeaways

Divide & Conquer – Small, specialized agents beat a single bloated model.

LLM + Quant > LLM Alone – Deterministic finance still needs statistics.

Intents Are the New Meta – They translate human goals into safe, executable DeFi actions.

What’s Next for Velvet Capital?

Public Alpha of the AI Co-Pilot vault manager is live on Base, Solana, BSC, and Ethereum.

Ongoing R&D on self-improving autonomous vaults—think “set-and-forget” strategies with dynamic risk controls.

Collaboration with other ACP pioneers to enable inter-agent liquidity, research, and compliance services.