Want to diversify your portfolio? Adding some crypto might help

It may sound counter-intuitive, but allocating up to 6 percent in crypto can help your portfolio achieve better risk-adjusted returns.

We know, it may sound counter-intuitive.

On the one hand, an asset class that repeatedly makes headlines for its periods of wild price appreciation, only to be followed by episodes where prices seem to know no bottom. Nothing exemplified this more than the crypto space’s most prominent representative, Bitcoin, which multiplied its value by 18x in 2017, only to give back three-quarters of the appreciation the following year. Whichever way you look at it, volatility seems to be part of the DNA of cryptocurrencies.

On the other hand, that “d” word that anyone who claims to be a financial expert likes to use. Yes, we’ve all been advised at some point to diversify our investments, and in doing so to dampen the volatility and downside risk of our portfolios. Anyone who takes an intro finance course learns to worship diversification as the path to achieving the optimal portfolio.

So how can these — at first glance — completely contradictory concepts come together?

To make sense of all this, let’s take a page from the basics of portfolio construction, without going into the theoretical detail. Essentially, what matters for determining a portfolio’s overall volatility is not just how each individual asset in that portfolio varies; rather, it’s equally important to consider how these assets correlate with one another. All else equal, the lower (or more negative) the correlation between two assets, the smaller the overall portfolio’s volatility. To put it in the context of crypto, even if crypto’s standalone volatility is high, if it has near-zero or even negative correlations to other assets, it would have a meaningful diversification effect on the overall portfolio.

What the data suggests

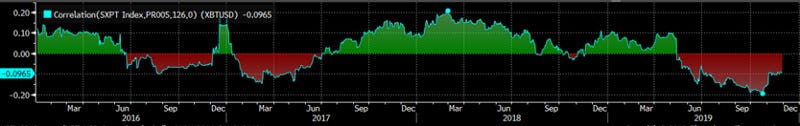

A cursory look at historical correlation data certainly seems to support this proposition. In fact, Bitcoin’s six-month correlation to every asset class we generally classify as “traditional assets” (equities, bonds, currencies, commodities) has consistently remained below 0.20, and is very often negative.

Bitcoin six-month rolling correlations vs traditional asset classes

BTC to S&P 500: -0.10 (current)

BTC to Barclays Global Agg (Global Bonds): 0.10 (current)

BTC to Dollar Index (USD vs basket of six developed market currencies): -0.25 (current)

BTC to Brent Crude: -0.04 (current)

Source: Bloomberg. Six-month rolling correlations shown. As of 29 November 2019

Researchers at Yale took this a step further. They examined in greater detail how much three of the most widely traded cryptocurrencies (Bitcoin, Ripple, Ethereum) behave like traditional asset classes. Specifically, they looked at to what extent these three cryptocurrencies are driven by the same risk factors. Their conclusions generally support the notion that cryptocurrencies trade fundamentally differently from traditional assets, and should in turn bring about diversification benefits. Notably, the three crypto assets’ exposures to the following are almost entirely statistically insignificant:

Risk factors generally associated with equities (the so-called Fama-French risk factors*)

Broader set of 155 other factors (from revenue growth and share repurchase activity to earnings surprises)

Exposures to common macroeconomic factors (consumption growth, industrial production growth, and personal income growth)

Exposure to major currencies (Australian Dollar, Canadian Dollar, Euro, Singaporean Dollar, and UK Pound) and to precious metals commodities (gold, platinum, and silver)

Interestingly, aside from the potential diversification benefits, the authors’ research also suggested that crypto’s volatility, while high, is not necessarily disproportionate when considering crypto’s higher average returns. In fact, on a monthly basis, crypto’s risk-adjusted returns are comparable to those of stocks. On a daily and weekly basis, crypto’s risk-adjusted returns are even higher than those of stocks.

In addition, one of the researchers in the study was quoted as saying in a separate interview that adding Bitcoin in moderation (up to 6 percent of overall assets) could help optimize portfolios. Indeed, combining a 6% crypto allocation with the S&P does appear to have achieved meaningful outperformance over the past four years, and at a slightly lower volatility as well.

Performance since Jan 2016 — S&P vs. mixed portfolio (94% S&P, 6% crypto)

* The five Fama-French equity risk factors are: (1) excess return of broader equity market, (2) small minus big, (3) high minus low (i.e. value minus growth), (4) robust minus weak op profitability, (5) conservative minus aggressive

What this all means for your portfolio

The data we’ve referenced here appears to validate crypto’s potential to effectively diversify your portfolio and reduce the volatility of your investments. Of course, what we’ve presented is just a small subset of the possible ways to approach this topic, and based on a particular research methodology. As crypto as an asset class gains more prominence, more research on the asset class’ effectiveness as a diversifier is likely to emerge.

In all cases, investors should take their time to familiarize themselves with this relatively new asset class, and only invest once they are comfortable with the potential risks involved. This is where Velvet.Capital can help.

We at Velvet.Capital serve a dual purpose:

For those who are already keen on adding some crypto to their investment portfolios, we facilitate access to pre-curated crypto indices through an affordable and secure platform. On Velvet.Capital, investors can buy passive crypto portfolios which are automatically rebalanced to ensure your portfolio’s value is driven by a broader market basket of crypto assets, and not by a single asset.

Easy: “One click” and you get the whole portfolio of digital assets managed automatically (you don’t need to put any effort into research or trading)

Curated: Transparent back-tested passive portfolios (and, in the future, hedge funds) created and hand-picked by finance professionals

Secure: You don’t transfer us your money, they always stay in your account under your name on the world’s largest and safest exchange (Binance)

Accessible: We are bringing all these benefits for about the price of a cup of coffee, and you can start as small as you want as there’s no minimum amount

Our first live portfolio is an index of top-30 most liquid crypto assets, equally weighted. We also have three more indices currently in development (momentum, low-volatility, and hybrid).

For those who are still unsure about whether crypto is right for you, we strive to contribute to the broader discussion on this emerging asset class through regular blog posts to help you make an informed decision. Stay tuned!

The Velvet.Capital Team