Weekly Crypto Alpha: Binance vs. Gensler; Robinhood drops Polygon; & more! 🧠

Gensler continues his fight vs. Crypto, the rise of Real World Assets on the blockchain, Bitcoin miners avoid a 30% tax, and much more!

GM

You get a lawsuit, you get a lawsuit, and you get a lawsuit!

Okay, not everyone's getting a lawsuit but it sure feels like it.

It’s been an extra busy start to the summer season in the world of web3! So let’s dive in. In this edition of our newsletter, we’ll explore the rise of NFT lending and concerns over predatory platform behavior, celebrate Nubank’s milestone in Mexico, and discuss how crypto miners dodged an energy tax.

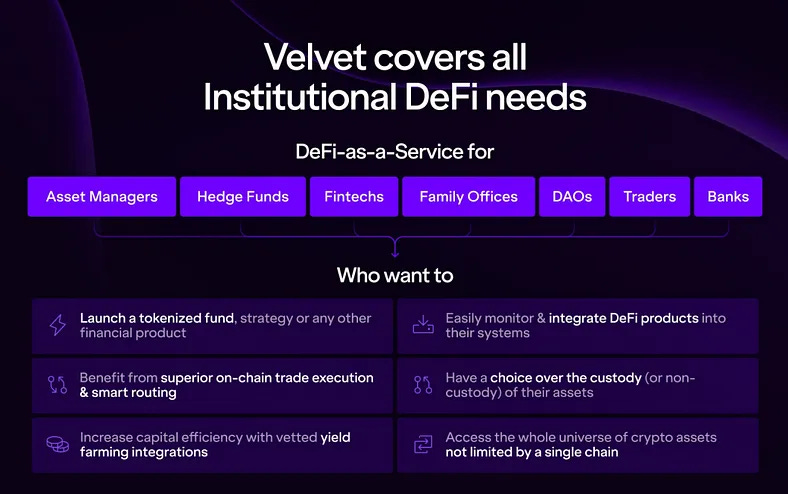

As the DeFi landscape continues to evolve at a breakneck pace, Velvet.Capital is here to keep you informed on the trends, challenges, and opportunities shaping this exciting sector!

Quick Hitters

· Optimism has launched its ‘Bedrock’ update, bridging the Ethereum mainnet and the Optimism L2, aiming to lower transaction fees and enhance node performance.

· Aave proposes $GHO stablecoin on Ethereum Mainnet, garnering considerable support in Aave’s governance forum.

· TLDR Swift is testing cross-chain tokenized asset transfers using existing infrastructure across public and private blockchains, including Ethereum.

· Curve’s stablecoin integration with Lido’s stETH enables a 15x increase in crvUSD debt ceiling, promoting scalability.

· Louis Vuitton debuts €39k ‘Treasure Trunk’ NFTs:

· Circle, the issuer of USDC, has acquired a major payment institution license for digital token services in Singapore.

· Doodles enters the retail market via CAMP Stores, converting its NFTs into real-world experiences.

· Russia’s leading bank, Sberbank, plans to launch digital asset services in June, enabling customers to buy, sell, and conduct transactions with cryptocurrencies through the bank.

· In response to recent SEC lawsuits, Robinhood removed support for Cardano, Polygon, and Solana tokens, giving users until June 27 to withdraw or sell:

· The Arbitrum network halted transaction processing for over an hour due to its sequencer running out of gas funds.

In The News

Centrifuge Looks to Help DAOs Invest In Real-World Assets

Centrifuge is on a mission to empower DAOs by facilitating investments in real-world assets. By tokenizing these assets and utilizing them as collateral for loans, Centrifuge aims to unlock unique liquidity opportunities. This innovative approach not only allows DAOs to diversify their portfolios but also helps reduce their dependence on the often-volatile cryptocurrency market. As a result, DAOs can achieve a more balanced investment strategy and potentially mitigate risks associated with digital asset investments. Moreover, Centrifuge’s groundbreaking model presents real-world asset holders with an unprecedented chance to tap into the thriving DeFi market. This access could lead to increased financial inclusion and create new avenues for both traditional and digital finance to coexist and flourish.

Binance Lawyers Allege SEC Chair Gensler Offered to Serve as Advisor to Crypto Company in 2019

The plot thickens…

In a recent legal dispute between Binance and the SEC, attorneys for the cryptocurrency exchange disclosed that SEC Chair Gary Gensler had expressed interest in serving as an advisor to the company back in 2019. This revelation has raised questions about potential conflicts of interest in the ongoing regulatory actions against Binance. The disclosure highlights the complex relationship between regulators and the rapidly-evolving cryptocurrency industry, as well as the possible implications of such connections on current and future enforcement actions. As the SEC continues to scrutinize digital asset exchanges and tighten regulations, the unfolding drama between Binance and the SEC serves as a reminder of the delicate balance between fostering innovation and ensuring investor protection.

NFT Lending is Trending, Raising Concerns of ‘Predatory’ Platform Behavior

As the popularity of NFTs continues to soar, a new trend has emerged within the industry: NFT lending. While this development presents exciting opportunities for both borrowers and lenders, it has also raised concerns about predatory platform behavior. Some NFT lending platforms have been accused of exploiting users through exorbitant interest rates and hidden fees, which may not only harm individual participants but also tarnish the reputation of the entire NFT market. This could potentially deter new users from exploring the world of NFTs and hinder the growth of the industry. To ensure the long-term success of NFT lending, it is crucial for the community and regulators to address these concerns and establish best practices that promote transparency, fairness, and user protection. By fostering a healthy lending ecosystem, the NFT market can continue to thrive and unlock new possibilities for creative and financial innovation.

Brazilian Digital Bank Nubank Hits 1 million Savings Accounts in Mexico

Brazilian digital bank Nubank has recently achieved an impressive milestone, amassing 1 million savings accounts in Mexico. This significant accomplishment not only highlights the fintech company’s successful expansion but also underscores the growing adoption of digital banking services across the region. Nubank’s rapid growth in Mexico reflects a broader trend of consumers embracing digital financial solutions, driven by factors such as convenience, accessibility, and enhanced user experiences. As traditional banks face increasing competition from disruptive fintech players like Nubank, the banking landscape is poised for a major transformation. This milestone serves as a testament to the potential of digital banking to revolutionize the financial industry and improve access to essential services for millions of people.

Crypto Miners Dodge 30% Energy Tax as Part of US Debt Ceiling Deal

In a recent development related to the US debt ceiling deal, cryptocurrency miners have avoided a proposed 30% energy tax. This decision comes as a major relief for the mining industry, which had been bracing for potential financial strain due to the tax on energy consumption. The avoidance of this substantial tax highlights the growing influence of the cryptocurrency mining sector and its ability to navigate legislative challenges. As the industry continues to mature, it is likely that miners will face further regulatory scrutiny and potential taxation hurdles. Nonetheless, this latest development demonstrates that crypto mining remains a resilient and adaptive industry.

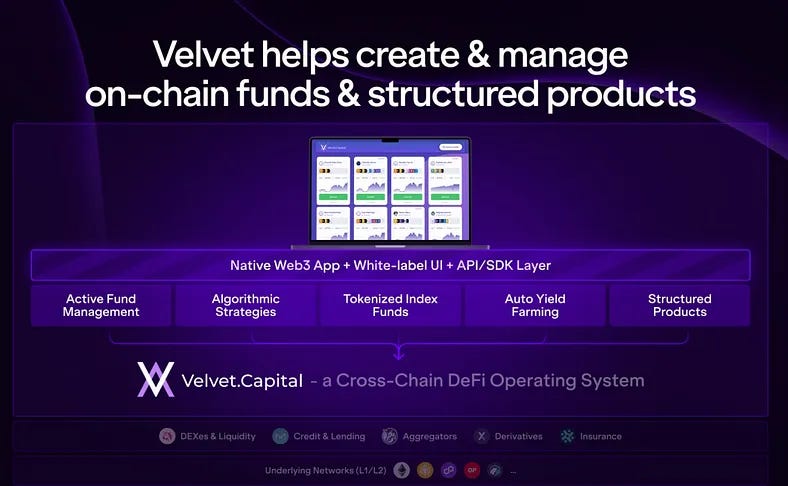

How Does Velvet.Capital Help You Achieve Crypto Success?

Create your custom portfolio today: https://velvet.capital/

Crypto can be hard. DeFi can be even harder! But it doesn’t have to be! At Velvet.Capital, we believe in DeFi done right. We’re passionate about the transformational nature of DeFi and want to help onboard the next billion users into crypto.

We help people create diversified crypto products with additional yield — all without giving up custody of their assets! No matter your level of expertise — we got you covered!

Our v2 is Right Around the Corner 👀

Join the Velvet Community today. Follow us on Twitter, LinkedIn and join us on Discord & Telegram for more updates! We want to hear from you, don’t be shy.

Cheers!