What are stablecoins? And how you can benefit from them.

Stablecoin 101 and how to best utilize them in your crypto portfolio.

What are Stablecoins?

There are 3 main types of stablecoin backing: Fiat, Collateral Debt, and Algorithmic.

Stablecoins are digital assets designed to maintain a stable value relative to a specific asset or currency, such as the US Dollar, Euro, or Gold. They can serve as a safe haven for investors seeking to preserve capital during bear markets. It is important to note that the stability of stablecoins can be impacted by the sufficiency of their reserves to cover withdrawals in the event of a bank run, as seen in the case of Terra Luna.

What can Stablecoins be used for?

Cryptocurrencies, such as Bitcoin and Ethereum, offer users a decentralized means of payment and store of value, eliminating the need for intermediaries. However, these digital assets are known for their volatility and fluctuating prices, which can make them challenging to use for everyday transactions.

New to trading? Try crypto trading bots or copy trading on best crypto exchanges

Stablecoins offer a potential solution to this issue by providing a more stable means of exchange and store of value. Additionally, stablecoins can provide returns through lending on decentralized finance (DeFi) protocols, where individuals can lend out their stablecoins and receive interest payments in a similar manner to traditional banks.

Growth of Stablecoins

Over the last few years, the popularity of stablecoins has grown drastically. From under a $500 Billion total value settled at the end of 2019 to over a $7 Trillion in 2022.

Using Stablecoins like an Investor

Stablecoins serve a variety of purposes beyond simply facilitating payments. Cryptocurrency traders may use stablecoins to secure profits, to hold funds during times of market stress, or to earn interest through lending on decentralized finance (DeFi) protocols. Investors may also choose to hold profits in stablecoins due to their ease of conversion and the speed at which they can be transferred compared to traditional fiat currencies.

In times of market uncertainty, stablecoins may also be used as a temporary holding place for funds while waiting for more favorable conditions. For example, when hearing about the possibility of FTX collapsing in early November, many experienced investors converted their digital assets into stablecoins to wait out the selling pressure that would come from a major player’s collapse.

Additionally, stablecoins can provide yield through the lending of tokens to DeFi protocols, allowing individuals to act as their own bank and earn interest on their holdings. With stablecoins, your interest payment is much more reflective of the borrower’s cost. If you want to start taking advantage of opportunities like this — lucky for you — Velvet.Capital has just launched a Stablecoin portfolio integrated with Venus.

Velvet.Capital Stablecoin Yield Portfolio

To help ease your investing experience, Velvet.Capital is releasing a Stablecoin portfolio- “Stablecoin yield”. This portfolio is a collection of the top 4 stablecoins on the market. The portfolio uses Venus (the leading DeFi Lending and Borrowing Protocol on BNB Smart Chain) yield farming to make sure you get the most out of your digital assets. This is our second community portfolio that uses Venus to increase your returns (with the first being Yield By Venus).

This portfolio has a mixed allocation of BUSD, USDT, USDC, and DAI.

In the portfolio, you also earn $XVS or Venus Token as well for additional yield.

Yield Per Asset

All of the assets in the Stablecoin portfolio have an allocation of 25%:

BUSD (25%): APY = 2.82%

USDT (25%): APY = 3.01%

USDC (25%): APY = 2.77%

DAI (25%): APY = 2.51%

Total Yield of Portfolio = 2.88%

*These numbers are dynamic and will fluctuate with market conditions

Know What You Own

BUSD (Binance US Dollar): A 1:1 backed stablecoin issued by Binance in partnership with Paxos (US regulated and based financial institution). BUSD is regulated by the New York State Department of Financial Services. Currently, BUSD has a market cap of $17 Billion.

USDT (Tether): One of the oldest stablecoins, starting in 2014. Tethers stablecoin pegged to the US Dollar issued by Hong Kong-based Tether. It maintains its peg to the dollar through commercial paper, fiduciary deposits, cash, reserve repo notes, and treasury bills so that the reserve equals the amount of USDT in circulation. Currently, USDT has a market cap of $66 Billion.

USDC (USD Coin): A 1:1 backed stablecoin issued by Circle. Its peg to the US Dollar is maintained through a mix of cash and short-term U.S. Treasury bonds. The current market cap of USDC is $44 Billion.

DAI (Dai): An Ethereum-based stablecoin issued by Maker Protocol and Maker DAO. DAI is softly pegged to the U.S. Dollar, unlike the other stablecoins in this portfolio. It uses a mix of Cryptocurrencies that are deposited into smart-contract vaults each time a new DAI is minted. Currently DAI has a market cap of $5.8 Billion.

This basket of stablecoins is meant to protect your buying power and minimize the downside in case one of the stablecoins fails.

Start Investing in Your Digital Future Today

2023 is going to be a transformational year for Velvet.Capital! Join us on our mission to make DeFi simpler and safer than ever before! Start building your portfolio for the next bull run now and set yourself up to benefit from our retroactive airdrop.

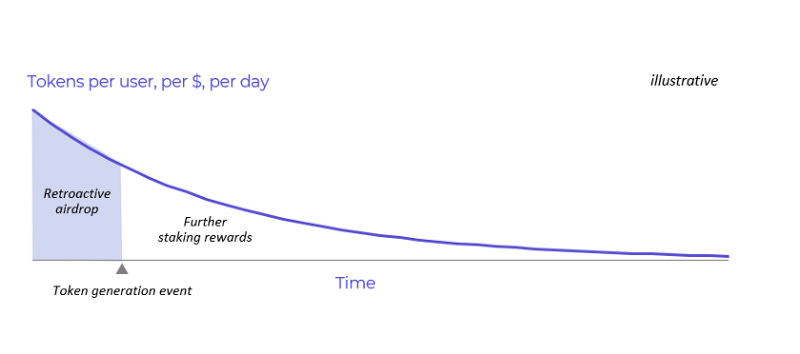

We’re creating a decentralized community-managed ecosystem. 50,000,000 VLVT tokens will be allocated to early adopters via retroactive distribution & further staking rewards. There are three main parameters in determining the allocation:

User’s Total Value Locked (TVL) on Velvet — the more you deposit the more tokens will be allocated to you

Time using Velvet — the longer you keep your deposit the more tokens will be allocated to you

Start date — the earning rate per day will be decreasing exponentially, the earlier you join — the larger allocation you’ll earn

Everyone is welcome at the Velvet Fam!

Follow us on Twitter, Instagram, LinkedIn and/or join us on Discord & Telegram for more updates!

Originally published at https://velvet.capital.